Portfolio Review

Chatham Rock Phosphate

Chatham Rock Phosphate (CRP) is the investment that we are most involved with operationally. After taking up our full entitlement in the recent rights issue, we are now the third largest individual shareholder in CRP with 6%.

CRP holds a granted mining licence on the Chatham Rise and is pursuing five exploration licences which are located offshore Namibia. These licenses were first applied for in mid-2012.

Corporate Milestones

As reported in CRP’s regular shareholder updates and other announcements made during the year, CRP is actively moving on a number of fronts despite the reduced size of the team.

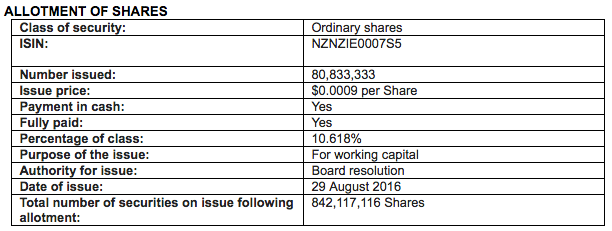

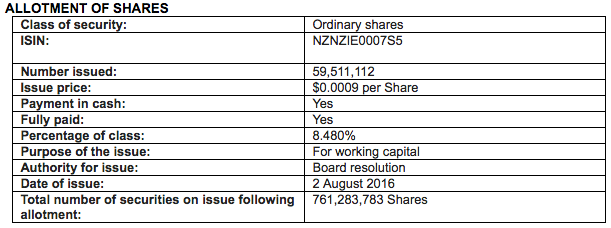

Impressively CRP has continued to raise the money they needed to remain viable and to maintain their momentum.

Over the past few months there has been a steady stream of support from CRP shareholders and new investors keen to support their plans. In total, Chatham has now sourced $3 million in the last 14 months. This is a remarkable achievement given both the major setback in CRP’s circumstances in March last year and the weak resource market conditions prevailing during the past 12 months.

CRP’s funds position will be improved further when they merge with cashed up Antipodes Gold, in order to list on the Canadian TSX-V market. Antipodes is listed in New Zealand so CRP shareholders will enjoy the best of both worlds.

The merger is expected to proceed as soon as CRP completes its recently announced share purchase plan and is expected to be completed by 30 September 2016.

Operational Focus

CRP executives have been steadily working through the steps required to resubmit their application for a Marine Consent. These include:

Ø Reviewing the previous application to EPA, as part of this CRP commissioned a 360 degree review from the key players involved in the last application.

Ø Working with officials in various government ministries to seek efficiencies in the permitting process – the recently announced Resource Legislation Amendment Bill has the potential to achieve these.

Ø Keeping a close watch on the actions of Trans Tasman Resources (TTR). Encouragingly TTR has already announced it intends to reapply for a Marine Consent, and it appears likely this application will proceed under existing legislation.

Ø Investigating and advancing trading relationships with other participants in the phosphate sector.

Ø Advancing towards sourcing reactive rock phosphate from several well located on-shore deposits.

Ø Continuing to build farming sector, academic, industry and central government support for the Chatham Rise project and for the use of Chatham rock phosphate as a sustainable, environmentally friendly phosphorous source.

Ø As part of this CRP has commissioned further pot tests to be followed by field trials.

Ø Attempting to resolve the fee dispute with EPA (unsuccessful so far).

Ø Seeking a refund of overcharged mining permit fees (reportedly now very likely to succeed).

Ø Being actively involved and frequently invited to present at fertiliser, resources sector and environmental conferences.

In summary, CRP is in very good heart, is well funded and has increasing forward momentum.

Asian Mineral Resources

AMR is one of the few new sources of nickel sulphide supply globally. AMR commenced commercial production from its Ban Phuc nickel project in Vietnam in mid-2013. The Ban Phuc project currently produces over 8,600 tonnes of nickel and 4,000 tonnes of copper per annum contained in concentrate, plus a cobalt by-product.

In addition to in and near-mine expansion projects, Ban Phuc provides a cash-generative operating platform from which AMR can continue to focus on developing a new nickel camp within its 150km sq of concessions located throughout the highly-prolific Song Da rift zone, where AMR has a number of advanced-stage nickel exploration targets.

Financial and Operating Results for Year Ended December 31, 2015

AMR recently reported the following financial and operational update for the full year ended December 31, 2015.

Operational Highlights

· 18% above target milled production of 447,746 tonnes (379,600 tonnes FY 2015 target)

· 8,607 tonnes of nickel contained metal in concentrate (FY2014: 6,854 tonnes)

· 4,011 tonnes of copper contained metal in concentrate (FY2014: 3,439 tonnes) and

· Above target nickel mill recoveries of 87.4% (FY2014: 85.2%)

· All mine capital development completed ahead of schedule in 2015

· Tailings dam construction completed for full current life of mine

Health, Safely and Environment

· Continued ongoing safety performance exceeding annual targeted rates

· No reportable environmental incidents.

Exploration

· Kingsnake geological mapping and trenching identifies 1.2km mineralized zone at surface with surface EM identifying the presence of EM conductors at depth.

Commenting on the year end performance, CEO Evan Spencer said:

· “We are extremely pleased with AMR’s performance given the extremely low commodity pricing environment throughout 2015

· Operational performance continued to achieve increased productivities enabling AMR to exceeded target production and sales volumes

· Despite the sustained drop in nickel price throughout 2015, increased production levels combined with our strong focus on efficiencies and cost reductions strategies enabled us to maintain cash flow going forward

· At the same time, AMR remains committed to pursuing growth opportunities, on our near-mine exploration and regional exploration targets with a priority focus on Kingsnake where exploration activities remain ongoing”

From our viewpoint, AMR is a very well managed company and remains a quality investment (if presently somewhat over-discounted by the market) with exciting prospects for the future.

Mosman Oil and Gas

In late 2013, Aorere converted a 100% interest in onshore West Coast oil prospect (Petroleum Creek) into approximately 10% of AIM listed Mosman Oil and Gas Limited, which now holds the oil interest. After selling a substantial part of our holding at higher prices prevailing before the oil price crash, we now hold a 2.6% shareholding in Mosman with a present market value of $72,000 at 0.72p.

Mosman is an Australia and New Zealand focused oil exploration and development company with a strategy to build a sustainable mid-tier oil and gas business by acquisition and organic growth. Current exploration projects include the following permits which are 100% owned:

· Petroleum Creek Project, New Zealand - the project is a 143 sq. km project located near Greymouth on the South Island in the southern extension of the proven Taranaki oil system.

· Taramakau Permit, New Zealand – the permit (990 sq. km onshore) surrounds the Petroleum Creek Project and shares similar geological characteristics and shares similar prospective play types.

· Murchison Permit, New Zealand – the permit (517 sq. km onshore) located approximately 100 kilometres north of Petroleum Creek has a 13 TCF contingent resource identified.

· Amadeus Basin Projects, Australia. Mosman owns two granted permits and one application in Central Australia which total of 5,458 sq. km. The Amadeus Basin is considered one of the most prospective onshore areas in the Northern Territory of Australia for both conventional and unconventional oil and gas, and hosts the producing Mereenie, Palm Valley and Surprise fields.

In a recent news release, the Mosman chairman made the following comments:

“2015 was a challenging year for the sector with continued oil price weakness and volatile equity capital markets, and as a result Mosman implemented a revised strategy and operational plan changing from its original focus on exploration (including drilling 3 wells) to seeking and securing a production asset. The revised plan was implemented to take advantage of the opportunity to purchase production assets, thereby providing cash flow and a medium term sustainable business model. The revised strategy was actioned and in September Mosman signed a contract to acquire the South Taranaki Energy Project ("STEP"'), an existing producing asset in New Zealand. However, the further subsequent significant reduction in the oil price in late 2015 and early 2016, together with related difficulties in obtaining government approvals, led to the cancellation of that acquisition.

As a result of the Board's actions to mitigate against further expenditure, Mosman remains in a sound financial position. Going forward, given the ongoing uncertainties associated with the current oil price and the lack of clarity on how long oil prices may remain at current depressed levels, and the continuing volatility in equity capital markets, the Board is also cognisant that it has a responsibility to continue to monitor and evaluate the effectiveness of its revised business strategy and plans over its current portfolio. The Board has also determined that it is prudent to evaluate other suitable opportunities to enhance shareholder value and this process is underway”

Given its nominal market value we consider Mosman an investment well worth holding.

Akura

Aorere has 8% of Fiji oil explorer Akura, which is presently re-applying for oil exploration licences in Fiji.

Earlier research and exploration by Akura has shown Fiji to have a high potential for the discovery of oil in onshore anticline traps associated with natural gas seepage, some dominated by butane. The main anticline target in the Nadi area has a projected length of 24 km, of which 12 km is coincident with natural gas seepage and such structures are capable of producing in excess of 100 million barrels of oil.

Breaking News – Investment in Nevada gold project

In November last year, Aorere Resources Limited through its relationship with local mining consultant Campbell McKenzie (Kenex Knowledge Systems) and Montana based Childs Geoscience Inc, happened across private group AIM (Nevada based American Innovative Minerals LLC), which was unexpectedly on the market sale due to the untimely deaths of its two geologist/prospector principals, Alan Branham and Don Decker.

Aorere, who invest in selected early stage minerals projects, subsequently undertook due diligence on the project.

AIM, and the flagship Fondaway Canyon Gold Project (“Fondaway”) in particular, fulfilled Aorere’s requirements of an advanced gold project, defined high grade resources, excellent infrastructure, in a safe haven with no known environmental issues.

This encouraged Aorere to assemble a technical team to expedite the purchase of AIM, with the objective of creating value by overseeing the immediate development of Fondaway. Negotiations have been successful and Aorere (through a newly incorporated company, Nevada Gold Limited) now holds an option to the 100% ownership of AIM and Fondaway.

Fondaway has indicated and inferred resources estimated to contain over 361,000 oz gold, averaging 7.1g/t gold, and showing growth potential estimates exceeding 1M oz gold, a net present value (8%) > $US 100M with possible gold production within three years.

Nevada is mining friendly, Fondaway has no identified environmental issues; infrastructure is simple in a district where access to professional and highly skilled labour and equipment is excellent.

The AIM purchase includes a portfolio of ten additional exploration projects in or adjacent to Nevada’s major gold districts, providing a pipeline for developing additional resource

Aorere is presently offering the opportunity to qualified investors to invest in Nevada Gold Limited, in a low sovereign risk major gold mining district, in Nevada USA.

Outlook

After a difficult year, we believe Aorere is now regaining momentum and prospects are improving on a number of fronts.

Chris Castle Dene Biddlecombe

Managing Director Chairman of Directors