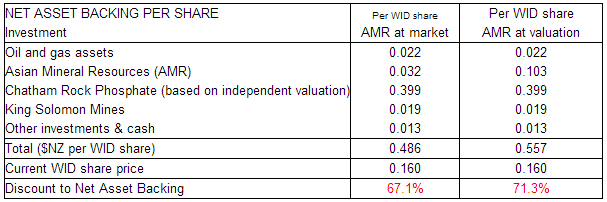

class="MsoBodyText3" style="margin: 0cm 0cm 0pt; padding: 0px; font-size: 11px; line-height: 16px; font-family: 'Lucida Grande', Lucida, Verdana, sans-serif; color: rgb(0, 0, 0); letter-spacing: normal;">The valuation of shareholding in the Chatham Rock Phosphate is based on two independent company valuations prepared in March 2011 which were used as a basis for the sale of our 10% shareholding in the Chatham Rise project to Chatham Rock Phosphate Limited

All other listed assets are included at market values with the exception of Asian Minerals which (as has been the case for nine of the last eleven years) is currently included at directors’ valuation. This valuation is based on our share of Asian Minerals net assets and takes into account independent project valuation data, the strategic nature of the shareholding, our close association with the company (including board representation) and some management involvement.

Chatham Rock Phosphate Limited (“CRP”)

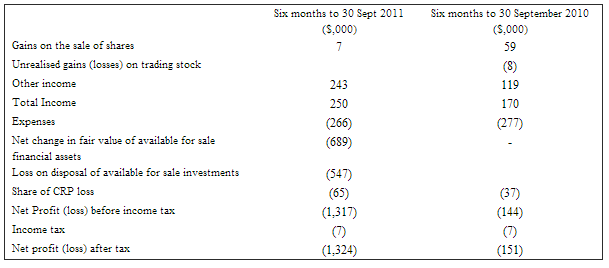

CRP recently announced a loss of $248,000 for the six months to 30 September 2011.

The increased deficit for the six months to 30 September 2011 reflected higher activity levels as the company moved into the second year work programme for the Chatham Rise Rock Phosphate Project.

CRP Operations Review

CRP is now a single project company, with the sole focus being the development of the rock phosphate deposit that sits within Mineral Prospecting Licence 50270 located on the central Chatham Rise.

The project now has significant momentum as milestones are being achieved across a range of initiatives. In the last 6 months there have been further developments on various fronts including operational matters, financing, and the proposed overseas listing.

Operational highlights

- In recent months there has been an ongoing dialogue with three local fertiliser sector companies and CRP now expects to be able to sell product to all three.

- Further market development work has been undertaken in Australia and throughout South-East Asia. Responses to initial contacts made have been encouraging and, given the two year lead time, CRP’s expectations are that it will have a healthy forward order book well before we are in full production

- A scoping study has been commissioned to determine the feasibility and economics of beneficiating CRP rock phosphate (effectively raising the level of contained phosphorous). If this is successful the indications are that CRP will be able to sell more product and for a better unit price.

- NIWA has completed a number of reports for CRP concerning various aspects of the Chatham Rise seabed environment. Further supplementary work is underway and once completed the reports will be published in order that there can be an informed discussion about what actually exists on and above the Chatham Rise and can put into context CRP’s planned activities there.

- Recently CRP executed an agreement with one of the world’s largest integrated dredging companies, Royal Boskalis Westminster for Boskalis to undertake a number of projects that collectively comprise phase one of the planned work programme. These projects include design engineering, logistics studies and preliminary design work and environmental studies including turbidity assessments. These projects were expected to take approximately six months and if successful could lead to phase two activities incorporating final design, detailed engineering, construction and testing.

Glauconite deposits

In mid 2011 CRP arranged for two moorings to be located on the central Chatham Rise in order to measure water currents and to collect other environmental baseline data. As this required a vessel to be out on the Chatham Rise for several days in May and then July CRP decided to collect bottom samples of sandy silt from various nearby locations. The primary purpose of gathering these samples was to assist Boskalis in refining the design of its phosphate nodule recovery system.

CRP also decided to undertake a detailed analysis of the constituents of the sandy silt and this work has recently been completed. While these results are limited to a small group of samples, they do demonstrate that there are significant quantities of glauconite contained within the seabed sandy silt layer that also contains the phosphate nodules. As such it appears possible the recovery system designed to gather the phosphate nodules may also capture the glauconite fraction without incurring additional recovery costs.

Accordingly, Boskalis has now been commissioned by CRP to conduct a check analysis of the sandy silt samples and to investigate the feasibility of a secondary recovery circuit that separates the glauconite particles. Preliminary laboratory tests of a separation technique have been encouraging on a very small scale but translating this successfully into a high volume extraction system may be challenging.

Glauconite is a mica-type clay mineral containing potassium, which makes it (like the Chatham Rise rock phosphate) an ideal slow release direct application fertiliser. It can also be used in glass manufacture and for paint pigments. Glauconite powder is presently sold in Russia for fertiliser use for US$365/tonne. Recent technological advances suggest that it’s now possible to separate potassium from glauconite, which could create another market opportunity as the demand for potassium (also known as potash) is substantial. Potash presently sells for US$470/tonne, rock phosphate for US$199.

Some of the samples gathered in May and July were in two areas within the CRP licence that had not previously been explored and which had not previously been tested for the presence of rock phosphate nodules. The good news is that rock phosphate nodules were found to be present in both areas and the presently established resource of 25 million tonnes is likely to increase.

Financing

In June CRP raised a further $1.6 million from the exercise of all the June 2011 options. These funds have enabled CRP to maintain forward project momentum during the subsequent months while progress has been made toward to the overseas listing signalled 12 months ago.

In view of continuing adverse market conditions and the forthcoming year-end holidays the board of Chatham Rock Phosphate last week resolved to defer its proposed offshore initial public offering until 2012.

The purpose of the IPO is to fully fund CRP through to a mining licence grant and commencement of production. Although it remains a priority to secure full funding for the project it’s considered in the best interests of all CRP shareholders to delay seeking full funding for now. When CRP does recommence with the IPO it will be able to act quickly because the documentation is well advanced, having prepared a draft prospectus and a project technical report.

The company does need to raise capital to avoid delays in its work programme and maintain operational momentum. The CRP board is presently considering the optimum level of capital needed to be raised during this intervening period and is starting discussions with qualified investors with a view to undertaking private placements. As these matters crystallise, further details will be released by CRP to the market.

Chatham Rock Phosphate – why CRP and Widespread Portfolios is excited about this project

The concept of recovering rock phosphate from the seabed in New Zealand territorial waters has a significant number of economic, environmental and market benefits.

The economic benefits include

- Import substitution of up to $300 million annually

- Possible exports to nearby markets

- Reduced commodity risk for fertiliser manufacturers and farmers

- Reduced foreign exchange risk for fertiliser manufacturers and farmers

- Development of a new industry

- Generation of additional income tax, GST and royalty income for the local economy

- Security of supply (most rock phosphate is imported from potentially unstable regimes in North Africa and the Middle East)

The environmental benefits include

- CRP product is significantly lower in cadmium and uranium than imported product

- Much lower carbon footprint than imported product

- If applied as a direct application fertiliser CRP has less run off than super-phosphate, is applied once every three years, and is a more effective, slower acting product

- Extraction will affect only 1/1000th of the Chatham Rise total area and will be intermittent

- Extraction will occur in accordance with International Marine Mining environmental guidelines

The market benefits include

- Much cheaper source than Morocco

- 25+ years security of supply

- Known extraction costs will allow fixed price contracts over several years which will benefit New Zealand fertiliser companies, farmers and agriculture outputs generally as fertiliser pricing will be less of a lottery