Dear Aorere Resources shareholder,

This announcement was released to NZX earlier today.

Regards,

Chris Castle

Director

Aorere Resources Limited

+64 (21) 558 185

chris@widespread.co.nz

www.aorereresources.co.nz

Interim Report to 30 September 2013

Directory

Directors: Dene Biddlecombe (Chair), Chris Castle, Jill Hatchwell, Linda Sanders, Denis Kelly

Contacts: +64 (3) 525 9170 or +64 (21) 558 185 or chris@aorereresources.co.nz

Website: www.aorereresources.co.nz

Headquarters: Level 1, 93 The Terrace, Wellington, NZ

Postal: PO Box 231, Takaka 7142, NZ

Registered office: 1232 State Highway 60, Onekaka, Golden Bay 7172, NZ

Share registry: Link Market Services, 138 Tancred St, Ashburton

Auditors: BDO, Tower Building, 50 Customhouse Quay, Wellington

Legal Advisers: Duncan Cotterill, Tower Building 50 Customhouse Quay, Wellington

Bankers: ANZ Banking Group (New Zealand) Ltd, 215-229 Lambton Quay, Wellington

Financial Result

Your directors submit the unaudited financial statements of Aorere Resources Limited for the six months to 30 September 2013. The trading result for the period was a loss of $229,000 (2012 loss $484,000).

Operations Report

2013 is proving a transformational year with some long term investments progressing well and some prospective investments offering significant promise.

Chatham Rock Phosphate

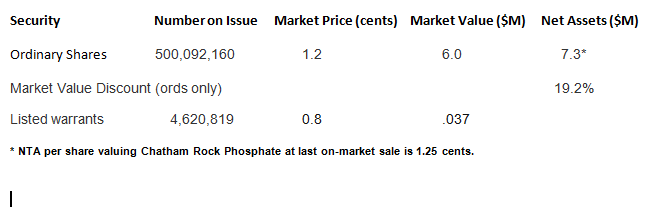

Mining Licence - Chatham is our most significant investment and continues to make strong progress towards its goal of extracting rock phosphate nodules from the seabed in 400 metre waters on New Zealand’s Chatham Rise in the Exclusive Economic Zone.

Our focus over the period under review has been attaining a Mining Licence from the Government agency New Zealand Petroleum and Minerals. We had initially expected approval shortly after the passing of the new Crown Minerals Act in late May. However, the process has proved longer and more complex than we anticipated so the Chatham Board decided to focus on achieving that licence before submitting its Marine Consent application.

The team has worked to satisfy the requirements of the new regime. As the first of this type under the new Crown Minerals Act, NZP&M has undertaken a robust assessment process, but it has taken considerably longer than we expected. Chatham is continuing to make good headway in gaining the Mining Licence and at the time of writing is confident it is close to getting over the line, with the final few outstanding issues close to being resolved.

Marine Consent - The additional time and cost involved in the Mining Licence process has meant the Marine Consent time line has been pushed into 2014, with plans to submit the formal application in the first quarter of the new year. The centrepiece of this application is a comprehensive Environmental Impact Assessment, comprising well over 1200 pages and including more than 30 reports produced by a variety of experts.

Chatham produced a near-final version in early July before deciding to hold off formally submitting it. Since then, the team has worked to further improve it – especially building in feedback from peer-reviews and ongoing consultation. The consultation has been very valuable as it has raised questions the team has been able to address and has helped hone the messages central to the proposals.

Capital raising, Consultation and Conferences - Capital raising has continued with an Initial Public Offering in the New Zealand market in June which raised around $1.5 million and gained another 125 local shareholders. Chatham has also raised further capital among international investors, primarily private equity funds and high net worth individuals.

In total, the company has raised $24.5 million over the past three years, with many original Chatham and Aorere investors continuing to support the various capital raisings. The boards of both companies are grateful for your continued support.

The Edison Group provided an update of operations in September, which assessed Chatham’s value above $2, based on an analysis of the business plan.

Chatham has continued to engage with stakeholders, including meetings with Labour MPs, another visit to the Chatham Islands and environmental groups. The team presented at conferences both internationally – including its third Underwater Mining Institute forum – and in New Zealand, where the team spoke to the Australasian Institute of Mining and Metallurgy, the Institute of Chartered Accountants and a Mining Summit targeting international investors.

The focus ahead

Once Chatham receives the Mining Licence, directors will be talking to a range of investors to raise the capital needed to fund the Environmental Consent process. Based on the current business plan, Chatham anticipates receiving its Marine Consent in the third quarter of 2014. During that period, Chatham will continue to work with its technical partner Royal Boskalis on ship design prior to starting the two-year ship conversion process with a target date for starting operations of the second half of 2016.

Asian Mineral Resources

Asian Mineral Resources Limited’s Ban Phuc nickel mine in northern Vietnam was formally opened at the end of June. Operations at the underground mine re-commenced on 10 May and, with the commissioning of the processing plant, production ramped up over the ensuing months to a target run-rate of more than 6,600 tpa nickel, 3,300 tpa copper, and 200 tpa cobalt contained in concentrate.

After a 13-year involvement in this project, it is satisfying to see the company finally become a producer.

While events – the 2008 global financial crisis and the imposition of an onerous tariff - conspired against us achieving the returns we had initially hoped for and caused significant dilution of our investment, it remains a significant milestone. It was pleasing to note the mine was constructed with zero lost time injuries – a world-class achievement.

AMR continues to focus on progressing opportunities to expand production, including extensions to the Ban Phuc massive sulphide vein, and selected higher-grade portions of the disseminated sulphide deposit. This will enable AMR to leverage the 30% additional installed capacity at its processing plant. Work is also progressing on developing a smelter that should reduce the export tariff and significantly improve returns.

Oil and Gas – Kotuku

In September, Aorere and Perth-based Mosman Oil and Gas announced plans to drill two onshore wells this summer at the Kotuku prospect on the West Coast. This follows approval from New Zealand Petroleum and Minerals to change conditions relating to Petroleum Exploration Permit 38526 over the Kotuku oil seeps near Greymouth.

The two-well programme is intended to provide sufficient data to establish an oil discovery and feasibility of commercial development. Mosman has indicated additional areas of the West Coast of interest for future investment. The new programme brings drilling ahead of the seismic testing with the plan to drill two exploration wells within the next 12 months, after which the permit holders will acquire seismic followed by another, perhaps deeper, exploration well.

In April, Aorere agreed to sell its interest in the permit to Mosman subsidiary Petroleum Creek. Aorere gained a 40% shareholding in Petroleum Creek and Mosman committed to fund the current work programme for the permit.

Mosman can exercise a call option to acquire Aorere’s Petroleum Creek shares by paying $900,000 in cash or in Mosman shares. In either case, Aorere has a 2% royalty over all petroleum obtained from the permit. Mosman brings extensive international experience in the oil and gas exploration sector and is backed by European, Australian and Asian investors.

Akura

Akura is a private company incorporated in Fiji with 38 shareholders, and 1.5 million shares on issue. Aorere holds 8% of Akura which has a strategic tenement holding in Fiji, with ~6,000 km2 as granted oil exploration licences and ~8,000 km2 as applications.

Research and exploration by Akura has shown Fiji to have a high potential for the discovery of oil in onshore anticline traps associated with natural gas seepage, some of which is dominated by butane. The main anticline target in the Nadi area has a projected length of 24 km, of which 12 km is coincident with natural gas

seepage and such structures are capable of producing in excess of 100 million barrels of oil.

Akura has entered into an agreement with Tavuni Capital, a Sydney-based capital services group, in relation to capital raising of F$1 to 3 million to acquire the onshore seismic data, select drill sites and complete feasibility studies for drilling.

King Solomon Mines

KSO is focused on the sale of Sonid North, its principal project in Inner Mongolia. The continuing difficult state of the commodities market has made it difficult to achieve an early sale.

KSO directors continue to review a number of minerals opportunities as potential acquisitions and they believe that the company will be successful in moving its focus to a new minerals opportunity.

A rigorous cost reduction approach is being applied by the company to minimise expenditure.

Outlook

We are currently assessing a some exciting new opportunities. It is too early to discuss these in any detail but your board considers them to offer significant potential.

Our focus of identifying and developing New Zealand based minerals and oil prospects is presenting some interesting possibilities.

Change in Auditor

We can also advise that Crowe Horwath has resigned from the office of auditor of the company. We thank Crowe Horwath for their assistance over their time as auditor. The Board has appointed BDO as the new auditor of the company.

On behalf of the Board

Dene Biddlecombe Chris Castle

Chairman Managing Director

27 November 2013