Aorere’s Asian Minerals announces management and board changes

/Asian Mineral Resources (“ASN”) is Aorere’s second largest investment. This shareholding represents 24% of Widespread’s total assets at ASN’s current market value of 2.5 cents in Canada.

ASN made the following announcement in Canada overnight which signals a period of likely change for the company. The good news is that we are still represented on the board continuing a 17 year involvement by Aorere with this company.

For and on behalf of the Board,

Chris D Castle

Managing Director

Aorere Resources Limited

Asian Mineral Resources Limited: Management and Board Changes

TORONTO, ONTARIO--(Marketwired - March 22, 2017)

Asian Mineral Resources Limited ("AMR" or the "Company") (TSX VENTURE:ASN) is pleased to announce changes to the management and Board of the company. The changes to the management and Board are designed to reposition the company to more effectively and efficiently advance the follow-up on the advanced-stage nickel exploration prospects on AMR's tenements in the prolific Son Da rift zone in Vietnam.

Chief Executive Officer

Mr. Duncan Blount has today been appointed Chief Executive Officer of AMR. Mr Blount is a highly experienced executive with over 10 years of investment experience focused on the natural resources sector. Most recently, Mr. Blount was Head of Emerging and Frontier Market Commodities for RWC Partners, responsible for developing their commodity and natural resources portfolio strategy. Mr Blount holds a BA in Language and World Trade from Samford University and an MBA from the Thunderbird School of Global Management.

Mr. Blount takes over the CEO role from Mr. Evan Spencer with immediate effect, though Mr. Spencer will remain with the Company during a transition period.

Mr Robin Widdup, Non-Executive Chairman of AMR stated, "On behalf of the Board, I would like to thank Evan for his tireless efforts in successfully steering the company through the completion of construction and operational ramp up of AMR's Ban Phuc Nickel Mine in Northern Vietnam through a very tough economic environment. Under Evan's leadership the Ban Phuc mine and processing facility transformed into a modern world class mining operation and an industry leader in Vietnam. We wish him well for the future. We welcome Mr Blount to the company and look forward to his leadership in realizing the full potential of the Ban Phuc project."

Chief Financial Officer

In keeping with the transition of the company to an exploration focused company, Mr. Sean Duffy will be leaving AMR at the end of March 2017 and Ms. Paula Kember, currently Corporate Secretary, will take on the role of CFO and Corporate Secretary.

Mr. Evan Spencer, outgoing CEO of AMR stated "Sean's financial leadership and guidance of the company through historically low nickel prices was a key contributing factor to AMR's reputation as a pioneer and a key industry leader in Vietnam. The management and board of AMR wish Sean well for his future."

Board of Directors

In accordance with the intent to transition AMR into an exploration company the AMR Board has also been streamlined to ensure its ongoing effectiveness and suitability for delivering on the exploration and development potential of AMR's exploration portfolio. In line with this restructuring Mr. Jim Askew (Non-Executive Chairman), Mr. Mike Brown and Mr. Evgenij Iorich did not seek re-election to the board of AMR at the annual AGM held on the 6th March 2017.

The Board currently consists of Mr. Robin Widdup (Chairman), Mr. Chris Castle and Mr. Martyn Buttenshaw.

Mr. Evan Spencer, outgoing CEO of AMR stated "We thank Jim, Mike and Evgenij for the significant contributions that they have made to the company during their tenure, successfully guiding the company from early stage exploration project to a modern world-class mining operation."

ABOUT AMR

AMR owns and operates one of the world's few sources of nickel sulphide ore, and is exploring for additional high-grade nickel assets in Vietnam. AMR commenced commercial production from its 90%- owned Ban Phuc Nickel Mine in Vietnam in mid-2013. As of 30 June 2016, the Ban Phuc Nickel Mine has produced a total of c. 20,000 tonnes of nickel and c. 10,000 tonnes of copper contained in concentrate, plus a cobalt by-product since the beginning of its mine life. Mining and processing operations at Ban Phuc were suspended in September 2016 and operations were transitioned to a care and maintenance scenario. In addition to in and near-mine expansion projects, Ban Phuc provides a platform from which AMR can continue to focus on developing a new nickel camp within its 150km2 of concessions located throughout the highly-prolific Song Da rift zone, where AMR has a number of advanced-stage nickel exploration targets.

For further details on AMR, please refer to the technical report entitled "NI 43-101 Technical Report - Ban Phuc Nickel Project" dated February 15, 2013 available on SEDAR or the AMR website www.asianmineralres.com.

Interim Report 6 months to 30 September 2016

/The interim report to shareholders for the six months to 30 September 2016 isavailable as PDF (link)

Financial results

Your directors submit the unaudited financial statements of Aorere Resources Limited for the six months to 30 September 2016. The trading result for the period was a loss of $521,000 (2015 - $149,000 loss). The increased loss arises after writing off the costs relating to the scoping, financing and acquisition of the Nevada gold project. Depending upon the outcome of that initiative some of these costs may be reversed and capitalised.

Operations Report

As at 28 November 2016, the market value of our portfolio comprised the following investments.

Portfolio

| Portfolio Analysis | ||

|---|---|---|

| Asian Minerals | 261,332 | 0.02 |

| Chatham Rock | 370,766 | 0.03 |

| Minor Investments | 30,025 | 0.00 |

| Akura | 9,855 | 0.00 |

| Cash | 132,070 | 0.01 |

| Accruals | (10,000) | (0.00) |

| 794,038 | 0.07 | |

Not included in the schedule above is a significant investment (in terms of both time and money) that has been committed by Aorere in putting together a deal whereby, Aorere could end up acquiring an investment in the various Nevada based gold assets presently held by American Innovative Minerals (“AIM”).

The outcome of this project is expected to be known within a matter of weeks. There are two possible outcomes – one being that we were not able to secure the finance to exercise the option to buy AIM for USD2 million. The other outcome, which is still achievable, is that we have secured enough financial backing, not only to acquire the AIM assets but to also fund the work programme required to increase the size of the gold resources to a substantially larger number than historically measured. This outcome will likely be very positive for Aorere and its shareholders. Negotiations with funding providers are ongoing.

Earlier this week we announced that Aorere Resources’ proposed Nevada gold investment is showing three times the gold resources previously estimated, following updated resource modelling.

Aorere announced today a significant increase in the Mineral Resource estimate to 1,069,000 ounces at a gold grade of 6.3 grams per tonne on a combined indicated and inferred basis.

The company has also secured an extension for the exclusive purchase agreement until the end of January 2017.

The discussion below deals with our existing portfolio.

Chatham Rock Phosphate

Chatham Rock Phosphate (“CRP”) remains the investment that we are most involved with operationally and it presently represents 46.7% of our assets. We are also the third largest shareholder in CRP with 5% and in conjunction with AOR and CRP directors the second largest holder with 8.5%.

CRP was granted a mining permit in 2013 to develop New Zealand’s only significant source of environmentally friendly pastoral phosphate fertiliser and is now preparing for a revised environmental consent application.

CRP’s role is focused on delivering a secure and sustainable local supply of low-cadmium phosphate that will reduce fertiliser run-off into waterways, produce healthier soils and shrink fertiliser needs over time.

The resource has an estimated gross value of $5 to $7 billion, representing one of New Zealand’s most valuable mineral assets and is of huge strategic significance because phosphate is essential to maintain New Zealand’s high agricultural productivity. Local and international investors have contributed more than $40 million to develop the project’s financial viability, environmental benefits and impacts, technical and logistical requirements, local and international product uses.

CRP proposes to extract up to 1.5 million tonnes of phosphate nodules from the top half metre of sand on identified parts of an 820km2 area on the Chatham Rise, 450km off the west coast of New Zealand, in waters of 400m. The earlier environmental consenting process has established extraction would have no material impact on fishing yields or profitability, marine mammals or seabirds.

In progressing plans to submit a new application, CRP is working with government officials to seek improvement in the permitting process and iwi, academic, industry and central government input to ensure New Zealand can benefit from an environmentally superior phosphate source.

Progress is continuing to achieve a Toronto Stock Exchange listing, to provide a more useful share-trading platform for overseas shareholders and facilitate the capital raising needed for the consenting process and beyond.

CRP is also seeking to own other sustainable rock phosphate sources, to move from being a single project company.

Asian Mineral Resources

Our investment in Asian Mineral Resources (AMR) dates back to 2000.

AMR is TSX.V listed, was profitable in cash flow terms, employed until recently over 500 people and was said to be the largest tax payer in Hanoi. It came a long way from being effectively a privately owned exploration company with little cash and few prospects of finding any. Aorere was the catalyst that made the difference, funding the company for several years, introducing substantial investors, and arranging the TSX.V listing.

AMR mined the Ban Phuc nickel deposit for the last three years at an accelerated production rate and has now exhausted the high grade massive sulphide deposit. The surrounding disseminated sulphide deposit is not economic to mine so, a decision was made to transition the operation into care and maintenance. Management are now continuing to secure the operational assets and establish on-site detailed care and maintenance compliance and reporting protocols and processes.

AMR has commenced review and interpretation of its low level exploration activities which includes field mapping, trenching and soil sampling. Following the assimilation and interpretation of this new information AMR will be in a position to revise the project ranking and priorities of its 26 initial exploration prospects.

Further design planning and analysis of the Ban Phuc disseminated resource will continue with AMR looking to conclude a preliminary economic assessment level report by end of QTR 2 2017.

Akura

Akura holds certain oil and gas leases in Fiji that are presently in the process of being renegotiated. Aorere holds 7.5% of Akura and has board representation.

The Future

We hold stakes in two companies that still have significant forward momentum. Depending on the outcome of the present Nevada gold negotiations we may have a new project, or we may not, in which case we will focus on supporting both Chatham and the new Asian Minerals.

Chris Castle, Managing director

Peter Liddle, Chairman

22 December 2016

Aorere Resources Limited extends option to acquire Nevada gold assets

/7 November 2016

NZX Market Announcement

Aorere Resources Limited extends option to acquire Nevada gold assets

In May 2016, Nevada Gold Limited (a wholly owned subsidiary of AOR) (NGL) entered into a conditional term sheet securing the exclusive right to acquire American Innovative Minerals LLC (AIM) of Nevada, USA for US$2 million.

AIM holds the rights to the Fondaway Canyon Gold Project (the Fondaway Project), as well as a number of other advanced and early stage mining and exploration projects. The purchase of AIM was conditional upon the following:

(a) Due diligence: NGL carrying out a due diligence assessment of AIM to the satisfaction of its board; and

(b) Finance: NGL securing financing of US$3 million to satisfy both the US$2 million purchase price and AIM’s immediate working capital requirements.

NGL secured exclusivity until 31 October 2016 to acquire AIM (subject to the conditions noted above). Further details regarding AIM and the Fondaway Project were released to market on 16 and 26 May 2016 and are available on Aorere’s website: www.aorereresources.co.nz.”

AOR is pleased to advise that the exclusivity period has now been extended to 30 November 2016 with a view to the acquisition being completed on or before that date. While the above conditions remain outstanding, the due diligence assessment is virtually complete and steady progress is being made toward securing the funding required to satisfy the finance condition.

AOR will update the market on the transaction further in due course.

Regards,

Chris Castle

Managing Director

chris@aorereresources.co.nz

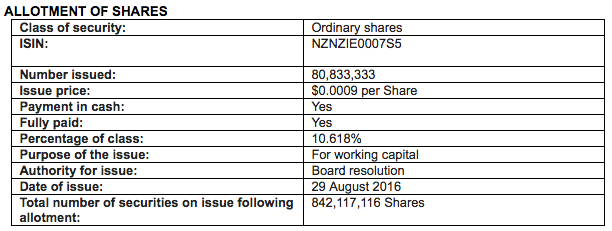

Aorere Resources Limited: Allotment of Shares

/29 August 2016

NZX Market Announcement

Aorere Resources Limited: Allotment of Shares

Aorere Resources Limited (NZX: AOR) advises that it has issued 80,833,333 ordinary shares (Shares) to qualified investors at an issue price of $0.0009 per Share, raising $72,750 in new capital.

One of the qualified investors has also committed to investing a further $62,250 into AOR under the Rights Issue Offer, which is scheduled to open on Wednesday this week.

Full details of the allotments are set out below.

On behalf of the Board,

Chris Castle

Managing Director

chris@aorereresources.co.nz

NZX Market Announcement: Aorere Resources Limited: Rights Issue

/9 August 2016

NZX Market Announcement

Aorere Resources Limited: Rights Issue

Aorere Resources Limited (NZX: AOR) advises that it intends to make a rights issue offer (Offer) to all AOR shareholders. The Offer price will be $0.0009 (0.09 cents) per share, to raise up to $685,000 (approx.) in aggregate.

The pricing of the Offer is at a significant discount to recent AOR share trades which have ranged between 0.2 and 0.4 cents since the AOR private placement fundraising programme of .09 cents commenced. The volume weighted average trading price during this fundraising period has been .224 cents, despite the fundraising at .09 cents, likely indicating strong investor support for the Company’s Nevada Gold strategy. The Offer gives all shareholders the same opportunity (at a 59.8 discount to recent trading prices) to support Aorere’s Nevada Gold project.

Shareholders recorded on the register as at the record date will receive renounceable rights to one new share for every existing share held. The rights will not be quoted on market.

Existing shareholder and retail investors may also apply for new shares subject to shortfall availability.

AOR intends to use the proceeds from the Offer, along with the capital raised from the recent placements, to finance costs in relation to the proposed acquisition of American Innovative Minerals LLC (AIM) through its wholly owned subsidiary Nevada Gold Limited (NGL) (including the compliance costs associated with the listing of NGL on the Toronto Stock exchange through a listed shell company).

The timetable for the Offer will be confirmed and advised to the market next week. It is intended that the Offer will be completed by the end of September.

On behalf of the Board,

Chris Castle

Managing Director

chris@aorereresources.co.nz

Aorere Resources Limited: Allotment of Shares

/2 August 2016

NZX Market Announcement

Aorere Resources Limited: Allotment of Shares

Aorere Resources Limited (NZX: AOR) advises that it has issued 59,511,112 ordinary shares (Shares) to qualified investors at an issue price of $0.0009 per Share, raising $53,560 in new capital.

As previously announced to the market, the capital raised will be used to cover the compliance costs associated with the listing of Nevada Gold Limited, a wholly owned subsidiary of AOR, on the Toronto Stock exchange through a listed shell company.

Full details of the allotments are set out below.

On behalf of the Board,

Chris Castle

Managing Director

chris@aorereresources.co.nz

Intention to make Private Placements

/9 July 2016

NZX Market Announcement

Intention to make Private Placements

Aorere Resources Limited (NZX: AOR) is intending to raise capital from qualified investors by way of placing approximately $126,000 of new shares (New Shares) at $0.0009 (0.09 cents) per share.

AOR intends to use the proceeds to finance costs in relation to the proposed acquisition of American Innovative Minerals LLC (AIM) through its wholly owned subsidiary Nevada Gold Limited (NGL). In particular, AOR has been closely investigating the listing of NGL on the Toronto Stock Exchange (TSX) to help finance the AIM acquisition and ongoing working capital requirements.

As first announced to market on 16 May 2016, AOR secured the exclusive right to purchase AIM which holds multiple exploration projects in resource-rich Nevada, including the flagship Fondaway Canyon Gold Project. AOR has been exploring a number of strategies to finance the acquisition of AIM and its initial working capital requirements.

Following two months testing of the investment market, AOR considers the best way to fund and develop the AIM project is to provide a listed company vehicle on a recognised stock market. A listing on TSX will provide further avenues of financing, with the TSX being a leading exchange for mining stocks, and exit opportunities for investors. Accordingly, AOR will use the raised capital to cover the compliance costs associated with the listing of NGL on TSX through a listed shell company (the TSX Listing).

Following the TSX Listing, NGL will move immediately to secure a financing to acquire AIM and proceed with the development of the project.

Extended Exclusivity Period

As announced to market on 16 May 2016, AOR signed a conditional term sheet securing the exclusive right to purchase AIM for the agreed purchase price of $2 million. The parties have agreed to extend the exclusivity arrangements to 31 October 2016. This will provide NGL with additional time to carry out due diligence, secure finance to fund the acquisition and finalise a sale and purchase agreement with the vendors.

On behalf of the Board,

Chris Castle

Managing Director

chris@aorereresources.co.nz