NZX Announcement: Asian Mineral drills 1.79 m of 1.73% Ni at Ban Phuc

/Dear Aorere Resources shareholder,

This announcement has just been released by NZX.

Chris Castle

Managing Director

Aorere Resources Limited

Cell: +64 21 558 185

17 June 2015

Dear Aorere Resources shareholder,

Our oldest investment, Asian Mineral Resources, made the announcement below in Canada last night.

Our shareholding in AMR is presently our third largest holding and represents approximately 20% of our assets.

Regards,

Chris Castle

Managing Director

Email: chris@widespread.co.nz

Asian Minerals drills 1.79 m of 1.73% Ni at Ban Phuc

2015-06-16 11:34 ET - News Release

Mr. Evan Spencer reports

ASIAN MINERAL RESOURCES IDENTIFIES MULTIPLE NEW HIGH-GRADE NICKEL TARGETS

Asian Mineral Resources Ltd. and its subsidiary, Ban Phuc Nickel Mines LLC, have released the latest results of the exploration program at and around its high-grade nickel mine at Ban Phuc.

Exploration highlights:

- Confirmed continuation of massive sulphide mineralization downdip at Suoi Phang. Results include 1.79 metres at 1.73 per cent nickel (hole SP14-4);

- 14 new high-priority targets identified to date, taking the regional inventory for nickel and copper targets to 28;

- New, high-priority mine extension target at Ban Phuc Deep following detailed structural interpretation and geological history of Ban Phuc. Follow-up drilling at Ban Phuc Deep planned for late June, 2015;

- New brownfields targeting model developed;

- Greatly increased understanding of geology and the Ban Phuc feeder structure at depth.

Evan Spencer, president and chief executive officer for Asian Mineral Resources, commented:

"The discovery of new high-grade targets close to our mining and processing facility is extremely encouraging. We are particularly pleased with the confirmation of massive sulphide mineralization at Suoi Phang. As our recent operational announcements confirmed, the last 12 months of production have exceeded expectations, and we now have the cash-generating platform to aggressively pursue the growth potential of our 49.7-square-kilometre exploration area. Vietnam benefits from low exploration costs and very strong community support. With our increasingly detailed understanding of the geology, we are excited about the region's potential to host a world-class magmatic nickel sulphide camp."

Exploration program overview

In July, 2014, Ban Phuc Nickel Mines was awarded the exclusive mineral exploration rights for continuing exploration of nickel-copper mineralization over a 49.7-square-kilometre area surrounding its Ban Phuc nickel mine located in the Ta Khoa region in northern Vietnam. Ban Phuc is within the Song Da rift, a major crustal suture zone, which is part of a broader northwest-trending corridor of deep continental rifting known as the Red River fault zone, which extends from northern Vietnam into China, and hosts a number of nickel, copper, lead, and zinc deposits and occurrences. The area is an excellent geological address in a geo-tectonic and structural zone that has many favourable factors for development of different styles of nickel-copper deposits, including Norilsk, Jinchuan and Voisey Bay styles.

Ban Phuc's massive sulphide nickel-copper deposit (MSV) is hosted by metamorphosed sediments (the Ban Phuc beds) adjacent to an ultramafic intrusion, which also contains disseminated nickel sulphides. Ban Phuc occurs close to the core of the regional-scale Ta Khoa anti-cline, which also hosts a number of other surface nickel and copper, and ultramafic occurrences.

Drilling was undertaken at Ban Phuc and Suoi Phang in August and September, 2014. These results, along with low-cost underground follow-up work to expand structural and geological mapping, and geochemical sampling coverage, have been integrated into a 3-D geological study aimed at understanding ore distribution trends, ore genesis and to feed into the exploration targeting model.

Ban Phuc drilling and mapping

During August, 2014, six diamond drill holes totalling 2,506 metres were drilled below the base of previous drilling at Ban Phuc. Results are provided in the attached table. Holes were drilled as a platform for investigations into potential depth extensions to the Ban Phuc MSV. Interpretation of this drilling has led to a new, high-priority exploration target known as Ban Phuc Deep. Drilling aimed to test this target is scheduled to commence in late June, 2015.

Two holes on the eastern and western extremities intersected thin intervals of deformed MSV, interpreted to be boudin neck sections of MSV, which is a common form of structural segmentation that results from regional extension and is observed elsewhere within the Ban Phuc MSV in underground exposures. While there was a lack of contained nickel, features observed in logging of these holes indicate a geological structure that has offset, rather than terminated, the MSV. Four holes did not intersect MSV nickel mineralization.

Surface mapping and 3-D modelling of the proximal disseminated material that took place during the first half of 2015 have identified a previously unrecognized, late-stage fault network which is projected to intersect the MSV below 1,110 maximum rate limitation (mRL). Kinematic measurements taken at the surface indicate oblique north block down sense of movement. Previous interpretations concluded that Ban Phuc MSV terminated at around 1,110 mRL; however, this recent work suggests that MSV has been offset by a fault.

Ban Phuc geological model

Recent studies have also led to a changed interpretation of the genesis of the Ban Phuc nickel-copper deposit. Ban Phuc has previously been considered to have experienced amphibolite facies metamorphism, under which sulphides were thought to have been remobilized (under pressure) from the ultramafic intrusion and concentrated within the pressure shadow. Recent observations suggest the Ban Phuc strata is of greenshcist facies rather than amphibolite facies, with petrographic work currently being undertaken. If the Ban Phuc strata is in fact greenschist facies, this implies lower temperature and pressure were experienced during deformation. This is highly significant, as it invalidates the previous genetic model, and under the new interpretation, there are significant potential size and geometry implications for the MSV.

A new genetic model is proposed for Ban Phuc:

- MSV zone represents a conduit that ultramafic melts and fluids feed an intrusive, and may have seen more than one phase of fluid/melt intrusion;

- Sulphides accumulated in the feeder rather than in the intrusion. This emplacement model has analogies in other known deposits, most notable of which is Voisey Bay.

This genesis model explains the lack of massive sulphides within the Ban Phuc ultramafic, and also the proximal, but not basal, relationship between MSV and the ultramafic.

The key implication of this reinterpretation is that much larger dimensions of a massive sulphide deposit are now considered possible than what was previously assumed for the Ban Phuc MSV.

Having identified a structure that has caused displacement of the geological sequence, the company is focused on locating a potential offset continuation of the MSV. Underground mapping data collected since mining commenced in 2013 display evidence of local offsets and deformation consistent with the new genetic model.

Suoi Phang drilling

During September, 2014, four shallow diamond holes were drilled at the Suoi Phang prospect for a total of 253 metres. Results are provided in the attached table.

The Suoi Phang prospect, located 12 kilometres in a direct line from Ban Phuc, contains a significant outcropping nickel gossan with a mapped strike extent of over four kilometres. Historic trench samples returned encouraging nickel results with grades of over 5 per cent nickel, providing the prospect with the potential for discovery of a new MSV orebody. Drilling in 2014 proved successful in locating the downdip extension of the MSV that presents at surface as gossan, and results included a significant intercept in hole BP14-4 of 1.79 metres of 1.73 per cent nickel.

Additionally, drilling at Suoi Phang also identified a late-stage fault which is interpreted to structurally offset the MSV.

Regional fieldwork and structural review

Following drilling, AMR commissioned a detailed geological review to support its exploration program and continuing regional geological understanding. The geometry and position of the MSV at Ban Phuc within the regional strain field have been applied regionally, and used in conjunction with recent modelling of geophysics and geochemistry to detect and rank potential new exploration targets, and to augment ranking of existing targets.

The geological review was completed by an experienced, Vietnam-based resources manager (Michele Spencer), deputy director/exploration manager, Dinh Huu Minh, and renowned specialists Ben Grguric (nickel mineral systems), Brett Davis (structural geology) and Darryl Mapleson (BM Geological Services).

This work has been highly successful in identifying 14 new high-priority targets within three kilometres of the mine, and almost doubling regional target inventory for further investigation on the company's granted exploration concessions. Targets are currently ranked according to proximity to infrastructure, and favourable geophysical, structural and geochemical features.

Following the success of this work in the near mine area, plans to extend structural targeting regionally are scheduled for later in the year.

Planned future exploration work

AMR has commenced a staged exploration plan aimed to test high-priority targets, further refine near-mine and regional targets, and continue to search for new targets, as well as to continually build the geological understanding of the region.

Highest-priority targets are Ban Phuc Deep, described above, and prospects along the Ban Khoa trend.

The Ban Khoa trend is a grouping of targets which extend for over 2.8 kilometres of strike to the east of Ban Phuc. Occurrences along the Ban Khoa trend bear many similarities to Ban Phuc and are interpreted to be an easterly continuation of the same geology, disrupted by a northwest-trending regional-scale fault that has offset the package to the north. The key geological elements of 1) ultramafic intrusion into Ban Phuc horizon sediments; 2) mapped massive nickel sulphides and/or nickel plus or minus copper anomalism at surface; and 3) geophysical conductors that appear to wrap around intrusives, are all present along the trend.

Work plans have been devised to test and upgrade key targets, focusing on Ban Phuc Deep and regional targets. The exploration work plan has been divided into two stages.

Ban Phuc Deeps:

- Drilling to commence late June, 2015, initially with three holes including downhole electromagnetic;

- Subject to results of drilling and downhole geophysics, a further five holes for a total of 1,600 metres are planned.

Regional program -- stage 1:

- Fieldwork to be conducted by company geologists to expand structural mapping and geochemical soil coverage over regions of high prospectivity;

- FLTEM survey to test for potential conductive targets in proximity to near-mine intrusions.

Regional program -- stage 2 (subject to results of stage 1 and board approval):

- Further fieldwork to extend coverage, and scope of surface mapping and geochemistry;

- Extend coverage and scope of geophysics (may include other methods);

- Extend detailed geological understanding across broader groundholding in the Ta Khoa region;

- Drilling of priority 1 targets.

The scientific and technical information in this press release has been compiled and approved by Darryl Mapleson (BSc (honours), FAusIMM), who is a geologist retained by Asian Mineral Resources, and a competent person as defined by JORC (Australasian Joint Ore Reserves Committee) guidelines and a qualified person for National Instrument 43-101. He has been working for Asian Mineral Resources as an independent consultant.

Note: Intercepts are downhole widths; recovery of samples was 100 per cent;

samples were analyzed using a mixed-acid digest with an ICP finish at

Bureau Veritas Laboratory in Perth, Western Australia. The grid system used

is VN 2000 zone 104.5.

SIGNIFICANT ASSAY RESULTS OF MSV AT SUOI PHANG IN HOLE SP14-04

Hole ID From (m) To (m) Intercept (m) Ore type Ni (%) Cu (%) Co (%)

SP14 01 NSI NSI NSI NSI NSI NSI NSI

SP14 02 NSI NSI NSI NSI NSI NSI NSI

SP14 03 NSI NSI NSI NSI NSI NSI NSI

SP14 04 21.15 22.94 1.79 MSV 1.73 0.3 0.04

Note: Intercepts are downhole widths; recovery of samples was 100 per cent;

samples were analyzed using a mixed-acid digest with an ICP finish at

Bureau Veritas Laboratory in Perth, Western Australia. The grid system used

is VN 2000 zone 104.5.

Brief backgrounds of key people

Ben Grguric -- independent consultant

Mr. Grguric has worked in the mining and exploration industry since 1993 in both operational and exploration roles, and specializes in mineralogy, petrology and the detailed characterization of orebodies. He has also spent several years involved in commodity targeting, grassroots exploration, project evaluation and feasibility studies worldwide. Throughout his career, his role commonly involved boundary-spanning geology and mineral processing, as well as industry and academia liaison, including supervision of research projects and collaborative research programs. Specialty commodities include nickel, gold, platinum group elements, uranium and base metal deposits. Mr. Grguric is a graduate of the University of Adelaide (BSc honours) and the University of Cambridge (PhD). He has held senior technical and managerial roles in WMC Resources, BHP Billiton, Western Metals, Norilsk Nickel Australia and is currently a freelance consultant. He is an adjunct fellow at the UWA-Centre for Exploration Targeting and a research associate of the WA Museum.

Brett K. Davis -- principal structural geologist (Orefind)

Mr. Davis is widely regarded in the exploration and mining industry for his application of applied structural geology to numerous commodity types and mineral deposit styles. The approach Mr. Davis has brought to understanding mineralizing environments globally is a product of the integration of modern structural geology and techniques married with several decades of applied research. Mr. Davis received a BSc (honours Class I) from James Cook University (1986) and has completed a structural geology PhD (1992) at James Cook University, followed by six years of applied structural geological postgraduate research. Mr. Davis has over 20 years of experience in the mining industry, and currently holds an adjunct senior research fellow position at the University of Western Australia.

Darryl Mapleson -- principal geologist (BM Geological Services)

Mr. Mapleson, BSc (honours), has worked in the minerals industry since 1989. He has substantial operational and exploration experience in nickel; working in multiple Kambalda nickel mines and the Perseverance operation in Leinster, Western Australia. Significant achievements include the building of a mineral services group of interrelated companies, which includes a geosciences company, a downhole directional and geophysical surveying company, and a surface diamond drilling company. Mr. Mapleson has more than 25 years of industry experience, and is a fellow of the Australasian Institute of Mining and Metallurgy.

© 2015 Canjex Publishing Ltd. All rights reserved.

Final announcement for the year to 31 March 2015

/Financial Result

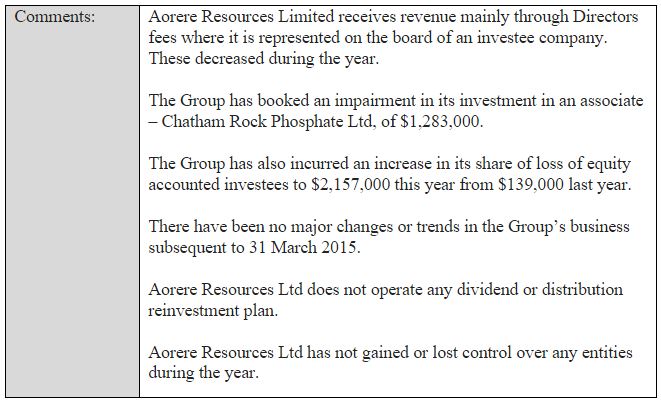

Your directors submit the audited financial statements of Aorere Resources Limited for the 12 months to 31 March 2015. The trading result for the period was a loss of $3.917 million. (2014 loss, $106,000).

Operations Report

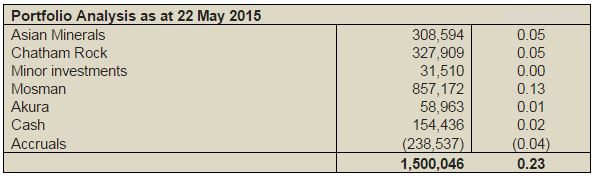

As at 22 May 2015, our portfolio comprised the following investments

Mosman Oil and Gas

In late 2013 Aorere converted a 100% interest in onshore West Coast oil prospect (Petroleum Creek) into approximately 10% of AIM listed Mosman Oil and Gas Limited, which now holds the oil interest. We now hold an 8.7% shareholding in Mosman with a present market value of $857,000 at 4.6p.

Mosman holds the following broad portfolio of oil and gas interests and we look forward with confidence to seeing these projects progress.

New Zealand

Petroleum Creek - 100% of permit PEP 38526, a 143 sq. km low cost onshore exploration project located on the South Island.

Taramakau, Murchison and East Coast – awarded as part of the 2014 Block Offer, increased exploration area in NZ from 143 sq km to 2,317 sq km.

Australia

Officer Basin - 25% of permit, 22,527 sq. km with significant exploration potential.

Amadeus Basin - 100% two permits and one application in Central Australia, 5,458 sq. km one of the most prospective onshore areas in Northern Territory.

Otway Basin - 30% of VIC/P62 in the Otway Basin, relatively shallow water.

Chatham Rock Phosphate

Chatham Rock Phosphate (CRP) is the investment that we are most involved with operationally even though it presently represents only 22% of our assets. After taking up our full entitlement in the recent rights issue we are now the largest individual shareholder in CRP with 10.9%.

CRP holds a granted mining licence on the Chatham Rise and is pursuing five exploration licences offshore Namibia, first applied for in mid-2012.

Recently CRP’s marine (environmental) consent application was declined and CRP’s board has spent the past three months evaluating the decision to determine the most appropriate path forward. CRP has dramatically scaled down operations until such time as a resubmission of the marine consent application is deemed appropriate.

Regardless of the future of CRP’s Chatham Rise project, the CRP board has determined the company will evolve from its single project focus into a more diversified company, principally involving other phosphate projects, both on and offshore.

Accordingly, due diligence is being undertaken in respect of a number of phosphate assets based both on and offshore in Australasia, North Africa, Southern Africa, Canada, USA and South East Asia. They range from green-field exploration projects, to those in development and near-to-production. Other marine mining opportunities involving other commodities will also be evaluated by the CRP team.

The main drivers for this evolution in the CRP business strategy is not only the desire to reduce investor risk, but also to take advantage of (and therefore retain) the significant institutional knowledge and expertise within the Chatham management team and partner organisations. This knowledge spans marine and environmental science, the development of offshore mining projects, and extensive knowledge of the phosphate market, both locally and internationally.

Chatham directors consider (and we concur) that the company’s ability to finance the eventual resubmission of the marine consent application will be enhanced if both existing CRP shareholders and potential new investors don’t face the same binary EPA-decision risk as in the past.

The acquisition and development of these new projects within CRP would be significantly easier if CRP was listed on a more recognised and liquid overseas stock exchange. The Toronto stock exchange is the most logical one as it is a leading exchange for mining stocks and also has a major fertilizer component.

CRP directors considered various options for the most cost effective way of listing and identified a reverse takeover of an existing TSX.V listed stock as most effective. That process has started and CRP’s identified partner Antipodes Gold, is currently undertaking due diligence on CRP. Aorere is supportive of this reverse takeover as a means to list Chatham on the TSX.V

Asian Mineral Resources

Asian Mineral Resources’ nickel mine in northern Vietnam has now been operating for two years, after commissioning in May 2013. In April AMR announced that in the year to December 2014 it had beaten production and recovery targets and had achieved a strong cash flow and a maiden net profit. Significantly, AMR had also been awarded a mineral exploration licence in July, 2014, covering 49 square kilometres of highly prospective ground surrounding the existing Ban Phuc mine.

Commenting on the year-end performance, chief executive officer Evan Spencer said:

"We are extremely pleased with AMR's performance. The operations ramp-up is now complete and we have exceeded target production and sales. Also, despite a recent drop in nickel prices, our robust management of mining processes and cost reduction strategies will enable us to maintain solid cash flow going forward. At the same time, we are continuing to pursue multiple growth opportunities, with a particular focus on our advanced near-mine and regional exploration targets, including a study which is being conducted on the disseminated resource and the results are expected by June."

Akura

Aorere has 8% of Fiji oil explorer Akura, which is presently re-applying for oil exploration licences in Fiji

Earlier research and exploration by Akura has shown Fiji to have a high potential for the discovery of oil in onshore anticline traps associated with natural gas seepage, some dominated by butane. The main anticline target in the Nadi area has a projected length of 24 km, of which 12 km is coincident with natural gas seepage and such structures are capable of producing in excess of 100 million barrels of oil.

Outlook

To complement our Mosman and CRP investments, your directors recently made an offer to Antipodes Gold to acquire their interests in two Waihi located exploration joint ventures with Newmont Waihi. Newmont itself has pre-emptive rights in respect of both JVs but has yet to advise whether or not these rights will be exercised.

If they do not, and Aorere is able to proceed with the acquisitions we will hold interests in two very interesting, strategically located exploration tenements within shouting distance of the existing mining operation. While there will be associated work programme commitments we believe that these should be able to be financed by further equity raises. This confidence is based upon published exploration results achieved to date.

After a pretty tough year, we believe Aorere is now has regaining momentum and prospects are improving on a number of fronts.

Chris Castle

Managing Director

For the full statement - click here

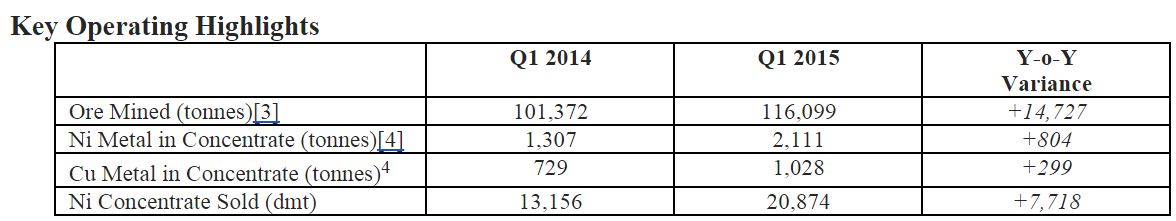

Asian Mineral Resources provides Q1 2015 operational update

/ASIAN MINERAL RESOURCES PROVIDES Q1 2015 OPERATIONAL UPDATE

Solid Production and Operational Outperformance, Significant Exploration Progress

Toronto, Ontario – May 21, 2015: Asian Mineral Resources Limited (“AMR” or the “Company”) (TSX-V:ASN) is pleased to provide an operational update for the first quarter of 2015 (“Q1”).

HIGHLIGHTS

· Strong Q1 production[1] and sales:

- 2,427 tonnes of nickel milled production;

- 1,096 tonnes of copper milled production; and

- 20,874 tonnes dry concentrate sold.

· Above target mill recoveries of 87% nickel and 94% copper remained strong during the quarter.

· Continued strong cost performance:

- Unit C1 (all in) operating cash costs[2], including royalties and export taxes, were reduced to US$ 4.63/lb.

· Strong cash and trade receivables position of US$9 million and continued debt reduction to US$14.0 million as at 31st March 2015.

· Significant progress with exploration activities continued with detailed structural mapping and ongoing geophysical modelling and review both at Ban Phuc and across the regional tenement package. This work continues to add greater understanding to the structural controls on high-grade zones within the disseminated resource base.

Commenting on the Q1 performance, CEO Evan Spencer said:

“It is extremely encouraging for us that the Q1 2015 performance has demonstrated AMR’s resilient operation even under a tough nickel pricing environment. Robust plant performance and cost management, combined with a strong focus on delivering upon key business improvement initiatives, have continued to realize key cost savings. AMR has maintained its ongoing operational focus at Ban Phuc while at the same time being able to maintain momentum and progress with its near-mine exploration programme over the quarter.”

PRODUCTION

AMR produced 2,111 tonnes of nickel metal, 1,028 tonnes of copper metal and 69 tonnes of cobalt metal in concentrate in Q1 2015. Continue operational optimization has resulted in a further increase in process plant nickel recoveries to 87%.

Four product shipments were completed in Q1 2015 in line with expectations, for a total of 20,874 tonnes dry concentrate. The average realized nickel price for the quarter was US$6.18/lb (US$ 13,625/ tonne).

FINANCIAL

The solid performance in mine production resulted in reduced C1 operating cash costs, net of by-product credits of US$ 4.63/lb. The declining trend in cash costs is expected to continue into the following quarter, as work on mine development is progressing ahead of schedule and the initial ramp-down in contractor equipment and manpower costs is planned to commence during Q2.

The company maintains a strong cash and trade receivables position of US$9 million as at March 31, 2015.

During the quarter a further US$2.0 million of debt was re-paid to LienViet Post Bank, bringing the total outstanding debt balance to US$14.0 million.

GOVERNMENT RELATIONS

During the quarter, Decree 12 was issued by the Government of Vietnam, as an amendment to the Law on Royalty. The Decree lays out the methodology for calculation of the royalty, which includes an allowance for a deduction of certain production costs from the royalty calculation. This is expected to have a positive impact on AMR’s total cost basis.

COMMUNITY RELATIONS

Throughout Q1 AMR continued its community school program to provide safe and reticulated electricity to three local regional schools. This included lighting, kitchen and ablution facilities to promote AMR’s commitment to the community and local education. Additionally, AMR’s Ban Phuc community relations team continued to work closely with the “Buddy Back Pack” initiative, assisting in the sourcing and provision to schools of essential educational supplies for both children and teachers.

PROJECTS

Disseminated

AMR is currently in the process of updating the geological model for the disseminated resource and continuing with the associated metallurgical test work programme. The disseminated mineralization contains a number of localized high grade zones and is located immediately adjacent to the Ban Phuc underground mine infrastructure, providing a potential low-capex development opportunity. AMR will be publishing an update on the results of the disseminated resource during Q2.

The disseminated mineralization, should it be found to be economic, would represent a material opportunity for AMR to extend the mine life of Ban Phuc while continuing to investigate regional exploration options.

Near-Mine Exploration

Near-mine exploration continued steady progress with key structural mapping and ongoing soil sampling activities. The combination of EM work and structural mapping by OREFIND consultants has continued to develop our knowledge of the region and the structural controls on mineralization. This has enabled a revision to AMR’s strategic targeting and re-prioritization of exploration targets.

NZX Announcement: AMR beats production and recovery targets, announces strong cash flow and maiden net profit

/Dear Aorere Resources shareholder,

The announcement below has just been filed with NZX and will be released before the market opens in the morning.

Regards,

Chris Castle

Managing Director

Aorere Resources Limited

Cell: +64 21 558 185

3 May 2015

Dear Aorere Resources shareholder,

Our oldest investment, Asian Mineral Resources, made the announcement below in Canada last Friday (Saturday here).

Aorere has played a significant part for the last 14 years in making this happen, and we should all be proud of that. During that period there were many obstacles placed in our path, and the odds stacked against us seemed unsurmountable at times.

There are obvious parallels with Chatham Rock Phosphate.

Our shareholding in AMR is presently our second largest holding and represents 16.6% of our assets.

Regards,

Chris Castle

Managing Director

Email: chris@widespread.co.nz

ASIAN MINERAL RESOURCES BEATS PRODUCTION AND RECOVERY TARGETS; ANNOUNCES STRONG CASH FLOW AND MAIDEN NET PROFIT

Asian Mineral Resources Ltd. is providing a financial and operational update for the full year ended Dec. 31, 2014.

Operational highlights

- Production ramp-up completed:

- 12 per cent above target milled production of 422,456 tonnes (375,000-tonne 2014 target);

- 6,854 tonnes of nickel contained metal in concentrate (2013: 1,166 tonnes);

- 3,439 tonnes of copper contained metal in concentrate (2013: 671 tonnes);

- Above target nickel mill recoveries of 85.2 per cent (2013: 78.5 per cent).

- Awarded a mineral exploration licence in July, 2014, covering 49 square kilometres of highly prospective ground surrounding the existing Ban Phuc mine.

Financial highlights

- Revenue of $87.8-million (2013: $9.2-million) and an average realized nickel price for the year of $7.75 (U.S.)/pound;

- C1 unit operating cash costs of $3.03/pound (2013: $5.15/pound);

- Strong operational cash flow of $17.6-million (2013: negative $2.5-million), allowing for:

- $14.4-million of capital investment;

- $3.4-million of debt repayments;

- Negative $200,000 due to cash movement and FX fluctuations.

- Gross profit of $15.6-million for 2014 (2013: $1.3-million);

- Net income of $6.5-million (2013: negative $10.8-million);

- Total cash and cash equivalents of $5.0-million and total current assets of $27.2-million as at Dec. 31, 2014.

SUMMARY ANNUAL FINANCIAL INFORMATION

2014 2013

Net sales revenue $ 87,818,927 $ 9,156,036

Gross profit $ 15,631,447 $ 1,253,998

Operating cash flow $ 17,634,240 $ (3,097,563)

Net income/(loss) $ 6,505,019 $ (10,807,985)

NZX Announcement: Mosman advises re Murchison project update

/29 April 2015

NZX Announcement

Mosman advises re Murchison project update

Mosman Oil and Gas has just made the attached announcement below in London.

Aorere Resources Limited holds approximately 10.1% of this AIM listed company, and our shareholding now has a present market value of NZD 1.07 million, based on the present market price of 5.25 pence.

As a result the undiluted net asset backing of an Aorere share (including all significant portfolio assets at market value) is now 0.26 cents. 61.6% of that value is represented by the Mosman shareholding.

Regards,

Chris Castle, Managing Director

Aorere Resources Ltd

To read the resource report - click here

NZX Announcement: Proposal by Aorere Resources to acquire gold joint-venture held by Antipodes Gold Limited.

/2 April 2015

NZX Market Announcement

Proposal by Aorere Resources to acquire gold joint-venture held by Antipodes Gold Limited.

Aorere Resources (AOR) shareholders have previously been advised of the desire of the directors to invest in New Zealand based minerals projects that fit our investment criteria. A number of possible projects have been investigated subsequently with none of these matching up.

However, more recently two very interesting gold related projects have been identified and subjected to preliminary due diligence. As a result of this a conditional sale and purchase agreement has just been signed with Antipodes Gold (AXG) to acquire the shares of their wholly owned subsidiary, Glass Earth (New Zealand) Limited (GENZL). GENZL holds joint venture interests in two Waihi based gold prospects with Newmont Mining Corporation (Newmont).

Subject to the following conditions it is proposed that AOR acquire GENZL for consideration of $1 million comprised of $800,000 in shares and $200,000 in cash. AXG would subsequently settle any existing liabilities and then intends to distribute the AOR shares to its own shareholders, with the aim of becoming a completely clean dual-listed (NZAX and TSX.V) “shell” company.

The agreement is subject to a number of conditions. These include:

- obtaining counterparty consents (such as Newmont’s consent and completing a pre-emptive rights process with them);

- relevant approvals being obtained;

- the tax implications of the transaction being confirmed;

- finance for the transactions being arranged (with the present intention of the AOR Board being to realise some of its existing investments);

- AXG putting in place arrangements to distribute the Aorere shares it receives; and

- Completing due diligence investigations.

In addition it is a condition that AXG make a share based takeover offer for Chatham Rock Phosphate (CRP) which will, when completed, result in CRP being owned 100% by AXG. The obligation to make a takeover offer is contingent however on at least 70% of CRP shareholders committing to accept such a takeover offer and the other conditions above being first satisfied.

AOR has facilitated this potential takeover as it considers it will be a positive development for CRP, one of AOR’s most significant investments. Due to the expected relative values of the two companies at the time the takeover will take place, existing CRP shareholders will own approximately 92.5% of the merged entity, which will then change its name to Antipodes Phosphate to reflect its primary focus on the phosphate market.

The outcome of these proposed transactions is considered by each Board of Directors to be in the best interests of the shareholders of all three companies involved. Please note these transactions are at an early stage and, as noted above, subject to a substantial number of conditions. These conditions will now be worked through and it is anticipated that, all going smoothly, the transactions contemplated would be completed in their entirety in August this year.

A copy of the CRP market announcement follows this announcement for shareholder information.

Chris Castle

Managing Director

Email: chris@crpl.co.nz

2 April 2015

NZX Market Announcement

Proposal by Chatham Rock Phosphate to list on Overseas Stock Exchange, acquire other Phosphate assets

Chatham Rock Phosphate shareholders will be aware from recent communications that, since the refusal of the Chatham Rise marine consent application, CRP has been assessing its overall business strategy.

We can now report that a decision has been made for CRP to evolve from its single project focus into a more diversified company, principally involving other phosphate projects, both on and offshore. Other marine mining opportunities involving other commodities will also be evaluated by our team.

The main drivers for this evolution in our strategy is not only the desire to reduce investor risk, but also to take advantage of (and therefore retain) the significant institutional knowledge and expertise that exists within our management team and our partner organisations. This knowledge spans marine and environmental science, the development of offshore mining projects, and extensive knowledge of the phosphate market, both locally and internationally.

We also consider that Chatham’s ability to finance the eventual resubmission of the marine consent application will be enhanced if both existing shareholders and potential new investors don’t face the same binary EPA-decision risk as in the past.

The acquisition and development of these new projects within Chatham would be significantly easier if CRP was listed on a more recognised and liquid overseas stock exchange. The Toronto stock exchange is the most logical one as it is a leading exchange for mining stocks and also has a major fertilizer component. We have considered various options for the most cost effective way of listing and identified a reverse takeover of a listed stock as most effective.

Accordingly one of our significant shareholders, Aorere Resources Limited has, with the support of the Chatham Board, signed a sale and purchase agreement with Toronto Venture Stock Exchange (TSX.V) listed Antipodes Gold (AXG) to acquire its core assets. Antipodes Gold is also dual listed on the NZAX.

Included as a condition in this sale and purchase agreement is that, subject to the fulfilment of a number of prior conditions, AXG make a share based takeover offer for Chatham under the Takeovers Code which will, when completed, result in CRP being owned 100% by AXG. Due to the expected relative values of the two companies at the time the takeover will take place, existing CRP shareholders will own approximately 92.5% of the merged entity.

The requirement to make the takeover offer will only arise however if the other conditions in the agreement (finance, due diligence, taxation confirmations, necessary approvals and consents) are satisfied and at least 70% of Chatham shareholders first commit to accept the takeover offer. The full takeover offer terms are yet to be formed and it is important to note that no takeover notice has been given and no shareholders have, at the present time, given any such commitments.

If the takeover is completed the merged entity will then change its name to Antipodes Phosphate to reflect its primary focus on the phosphate market.

It is then proposed that other projects will be acquired, by issuing equity, by the now dual (TSX.V and NZAX) listed Antipodes Phosphate and the enlarged group would subsequently seek to raise further funds in local and overseas markets. These funds would be utilised to advance the projects held within the group, including the Chatham Rise project, the other five permit applications already filed in Namibia, and the newcomers to the portfolio.

The outcome of these proposed transactions is considered by each of the respective Boards of Directors to be in the best interests of the shareholders of all three companies involved. Please note these transactions are at an early stage and, as noted above, are subject to a substantial number of conditions. These conditions will now be worked through and it is anticipated that, all going smoothly, the transactions would be completed in August this year.

We welcome shareholder feedback on this proposed transaction. A copy of the Aorere Resources market announcement follows this announcement for shareholder information.

Chris Castle

Chief Executive Officer

NEWS RELEASE 15-3

April 1 2015

ANTIPODES GOLD ANNOUNCES RESTRUCTURING DEAL

to PURSUE GOLD & PHOSPHATE OPPORTUNITIES

WELLINGTON, New Zealand – Antipodes Gold Limited (TSXV and NZAX: AXG, the “Company”) announced today that that it has signed an agreement to sell its gold exploration interests and undertake a reverse takeover of a listed New Zealand based phosphate development company. Both these transactions will require shareholder approval. An Information Circular and requisite supplementary reports will be provided to shareholders prior to the Special General Meeting, expected to be held in June.

The planning of these transactions is at an early stage and subject to a number of conditions, including those set out below. These conditions are being worked through:

- Completing due diligence investigations;

- Confirming the tax implications of the transactions;

- Obtaining counterparty consents;

- Obtaining relevant approvals (shareholder and regulatory);

- Securing interim financing for the transaction costs and G&A expenses;

- Ensuring a process to distribute shares it receives as part payment: and

- The requirement to make a takeover offer only arises if the other conditions in the agreement (finance, due diligence, taxation confirmations, necessary approvals and consents) are satisfied and at least 70% of the target company shareholders commit to accept the takeover offer.

As shareholders are aware, the Company has been seeking equity funding for some time, to advance its gold exploration interests in the Hauraki region in the North Island, New Zealand. In parallel with this, the Company and Newmont Mining Corporation (“Newmont”) have been rearranging their joint venture management and equity interests in order to facilitate the Company’s ability to raise funds and move forward on exploration. As equity funding could not be raised, the Company has sought to further restructure its business activities.

Sale of Gold Exploration Interests to Aorere Resources Limited (“AOR”)

The first transaction proposed is with AOR, an investment company listed on the New Zealand Stock Exchange main board (refer below for more information). In this transaction AOR will acquire the Company’s gold exploration assets by purchasing all the share capital in the Company’s wholly owned New Zealand subsidiary, Glass Earth (New Zealand) Limited (“GENZL”) for NZ$1 million (C$950,000). Exploration liabilities owed to Newmont will remain in GENZL as will potential royalty obligations relating to the exploration permits. Other trade liabilities in GENZL are to be settled as part of the sale process.

Recent encouraging drilling results at the Waihi West permit have been incorporated in the transaction value. The gold exploration assets are subject to pre-emption rights, exercisable by Newmont.

Should Newmont not pre-empt, AOR will pay for the GENZL shares by issuing NZ$800,000 in AOR fully paid ordinary shares and NZ$200,000 in cash. Some of the sale proceeds will be applied to meeting current debts and transaction costs. It is intended that any surplus AOR stock be distributed to AXG shareholders, subject to any regulatory requirements.

This should leave AXG as a listed shell company to undertake the second transaction, being a reverse takeover of Chatham Rock Phosphate Limited (“CRP”).

Reverse Takeover of Chatham Rock Phosphate Limited (“CRP”)

CRP is listed on the New Zealand Stock Exchange Alternative board (refer below for more information). It holds a mining permit over an area off the coast of New Zealand with significant seabed deposits of rock phosphate and other potentially valuable minerals.

CRP applied for a Marine (environmental) Consent to mine this in July 2014 and was declined in February 2015. CRP has advised that it is likely to pursue a re-submission of its Marine Consent application and has recently announced that it intends to raise NZ$1.38 million (C$1.3m) by a rights issue to its existing shareholders, in order to advance this project. CRP applied for five marine phosphate prospecting licences offshore Namibia in mid-2012 and has recently sought to accelerate the licensing process.

Subject to satisfaction of the various conditions referred to above, AXG may make a takeover offer for all of CRP’s issued shares, by issuing new shares of its own in exchange, such that, on completion it is intended that the Company’s current shareholders will retain 7.5% of the post-transaction Company. It is likely that Antipodes Gold would then be rebranded as Antipodes Phosphate.

General & Administration Costs and Transaction Costs

The Company’s ongoing minimalist G&A costs and its transaction costs to plan, prepare and carry out these transactions will be funded by AOR and/or parties associated with it. It is intended that AXG issue fully paid ordinary shares to AOR to discharge the resultant debt.

Antipodes CEO Thomas Rabone commented: “We are pleased to be presenting this deal to our shareholders. Potentially, it allows the company to meet its debts while providing our investors with a new shareholding and a new direction. As an NZ-listed minerals portfolio company, Aorere will be positioned, as the new holder of our gold projects, to maintain and develop their encouraging potential – and this transfer is designed to provide AOR stock to our current investors to still participate in that opportunity.

Plus, by undertaking a takeover for Chatham Rock Phosphate, the ongoing holders of AXG stock will gain an additional investment position – in an experienced junior resource company that is evolving to adopt a more diversified strategy.

This proposed transaction allows for the better realization of value from the Company. We consider it to be in the best interests of the shareholders of all three companies, and will be welcoming our own shareholders’ feedback.”

Disclosures

- Aorere and CRP are arm’s length parties. Mr Henderson, a director of the Company joined the AOR board of directors in 2014.

- There is no formal letter or agreement with CRP in respect of the proposed takeover offer. The takeover offer will be made under the New Zealand Takeover Code by the Company directly to the 800+ shareholders of CRP. CRP is in favour of the takeover.

- An exemption or waiver to the requirement for a Sponsor will be sought from the TSX.

- Completion of the transaction is subject to a number of conditions, including Exchange acceptance and disinterested Shareholder approval. The transaction cannot close until the required Shareholder approval is obtained. There can be no assurance that the transactions will be completed as proposed or at all.

- Investors are cautioned that, except as disclosed in the Management Information Circular or Filing Statement, to be prepared in connection with the transaction, any information released or received with respect to the RTO may not be accurate or complete and should not be relied upon.

- Trading in the securities of Antipodes Gold Limited should be considered highly speculative.

The TSX Venture Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release.

About CRP

Chatham Rock Phosphate is an NZ-listed mineral exploration company, focused on the development and exploration of a marine phosphorite deposit offshore New Zealand. CRP holds a Mining Permit of approximately 820km2 in respect of the Chatham Rise Phosphorite Deposit located in the offshore Exclusive Economic Zone of New Zealand. CRP has announced a decision to evolve from its single project focus into a more diversified company, focusing on both on- and offshore phosphate projects. For more information, visit www.rockphosphate.co.nz

About AOR

Aorere Resources, which holds approximately 8% of CRP, is an NZ-listed portfolio investment company, focused on selected New Zealand early stage oil, gas and minerals projects.

Aorere is capitalising on the networks developed and experience gained from establishing and managing Chatham Rock Phosphate, to develop a revised investment portfolio that is proposed to now include AXG’s gold permit interests. For more information, visit aorereresources.co.nz

About AXG

Antipodes Gold has been focused on establishing gold resources in New Zealand’s Hauraki region – host to low-sulphidation epithermal gold-silver deposits including the Newmont-owned Martha gold mine. For more information on the Company’s properties, and to subscribe to further news updates, please visit antipodesgold.co.nz.

Thomas Rabone

President and Chief Executive Officer

+64 22 649 9690

thomas.rabone@antipodesgold.co.nz

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) nor New Zealand Exchange Limited has reviewed this release and neither accepts responsibility for the adequacy or accuracy of this release.

NZX Announcement: King Solomon Mines advises director resignation

/4 February 2015

NZX Announcement

King Solomon Mines advises director resignation

King Solomon Mines made the announcement below on the ASX earlier today.

Aorere Resources Limited now holds only 2.1% of this ASX listed company, and our KSO shareholding is now only 1.1% of our portfolio. My resignation from the King Solomon Mines board should be viewed in that context.

Regards,

Chris Castle, Managing Director

Aorere Resources Ltd

NZX Announcement: Aorere Resources Limited Allotment of Shares

/Aorere Resources Limited (NZX: AOR) advises that it has today allotted a total of 5,949,001 ordinary shares.

2,544,529 of the shares have been issued to Chris Castle, Aorere’s Managing Director. These Shares are issued as consideration for services provided by Chris in accordance with his contract for services with Aorere. The shares were issued at the issue price of $0.00786 per share, reflecting the 20 day volume weighted average price of a share on the NZX Main Board to 31 December 2014.

Additionally, 3,404,472 shares in aggregate have been issued to Linda Sanders and Jill Hatchwell, respectively, as consideration for services rendered to Aorere, as Directors (in accordance with the relevant contracts for services with Aorere). The shares were issued at the issue price of $0.00738 per share, reflecting the 20 day volume weighted average price of a share on the NZX Main Board to 10 December 2014.

Full details of the allotments are set out below.

For and on behalf of the Board,

Chris Castle

Managing Director