NZX Announcement: Asian Mineral Resources Update

/

Asian Mineral Resources Continues Strong Operational Performance; Strong EM Conductors Identified at Kingsnake Exploration Prospect

TORONTO, ONTARIO--(Marketwired - Oct. 28, 2015) - Asian Mineral Resources Limited ("AMR" or the "Company") (TSX VENTURE:ASN) is pleased to provide an operational update for the third quarter of 2015 ("Q3").

HIGHLIGHTS

· Above-guidance Q3 production(1):

o 2,629 tonnes of nickel milled production;

o 1,109 tonnes of copper milled production; and

o 14,050 tonnes dry concentrate sold.

· Mill recoveries exceed targets at 87.7% nickel and 95.3% copper.

· C1 unit operating costs(2) below-guidance at US$ 3.49/lb Ni, including royalties and export taxes.

· Full repayment of the outstanding term loan facility of US$12 million and repayment of US$2.7 million working capital facility.

· 1.2km mineralized zone identified at the Kingsnake prospect; Electromagnetic ("EM") conductors identified at depth.

· Concentrate sales lower than forecast due to delays associated with shipping to Tianjin port.

Commenting on Asian Mineral Resources' Q3 performance and exploration progress, CEO, Evan Spencer, said:

"AMR's strong operational performance has continued to underpin the business during this extended low-pricing cycle. As notified to the market on 30th September 2015, sustained strong operational performance combined with our ongoing stated objective to reduce costs enabled Ban Phuc Nickel Mines, AMR's Vietnamese subsidiary, to pay down US$14.7 million in debt during the quarter. The subsequent temporary delay in BPNM's nickel concentrate shipments to Tianjin port has not impacted the operation. Shipments have re-commenced and we expect to return to our normal shipping schedule over the coming months. The short-term bridge facility provided by our major shareholder, Pala Investments, has enabled us to work though this delay in shipping in a controlled fashion.

Exploration at our high priority Kingsnake prospect has provided exciting results. The structural re-interpretation combined with field mapping, geochemical sampling and surface EM work undertaken during Q3 has identified the potential for a mineralized system up to 1.2 km in length at Kingsnake. The presence of a number of EM conductors at depth has enable detailed drill targeting to begin. The confirmation of mineralization at Kingsnake is a significant discovery and provides the opportunity for AMR to access additional mineralization from the existing mine infrastructure should economic quantities of mineralization be confirmed."

PRODUCTION

AMR produced 2,307 tonnes of nickel metal, 1,058 tonnes of copper metal and 75 tonnes of cobalt metal in concentrate in Q3 2015. Optimization of the processing circuit implemented during Q2 has resulted in a sustained improvement in processing recoveries with Q3 2015 recovery achieving 87.7%, above a design target of 85%.

Three product shipments were completed in Q3 2015. This was below expectation due to the unplanned shipping delays to Tianjin in September, for a total of 14,050 tonnes of dry concentrate. The average realized nickel price for the quarter was US$4.40/lb (US$9,699/tonne).

Key Operating Highlights

FINANCIAL

All key capital expenditures were completed in Q3 as planned. The Ban Phuc mine has now shifted to a stoping operation having completed all planned underground development. This will allow further sustainable reductions in operating costs through 2015 and into 2016. C1 operating cash costs for Q3 were, net of by-product credits and inclusive of all royalties and tariffs to US$ 3.49/lb (Q2 2015: US$4.55/lb).

During Q3 AMR paid down US$ 14.7 million in debt as part of its strategy to reduce costs and generate greater flexibility with cash management. Subsequent to AMR paying down its in-country term loan facility, Ban Phuc concentrate shipments via Tianjin port were impacted. To ease short-term cashflow as a result of these shipping delays, AMR through one of its wholly owned subsidiaries, entered into a short-term US$2.1 million facility with its major shareholder, Pala Investments. This facility is expected to be repaid during Q4 2015. Shipping operations recommenced in October and AMR will begin to reduce finished product concentrate stockpiles during the quarter.

As of 30th September, the company had a cash and trade receivables position of US$ 2.1 million.

KINGSNAKE EXPLORATION

The Kingsnake prospect, as discussed in the press release of 16 June 2015, is one of AMR's high-priority exploration targets identified along the 2.8km Ban Khoa trend. The Ban Khoa trends sits approximately 1km to the north east of the existing Ban Phuc operations.

During the quarter, planned exploration activities at the Kingsnake prospect focused on continuing to understand the structural controls and map the extent of the Kingsnake trend. This work initially focused on field mapping and trenching to confirm the surface expression of the Kingsnake structure and was followed up with focused Fixed Loop Transient Electromagnetic ("FLTEM") geophysical surveys.

Seven trenches were dug to facilitate the mapping of the outcropping 525 meter strike extent of the nickeliferous gossan. Mineralization consists of a shear controlled tremolite dyke and brecciated MSV with dip direction varying between SW to NE, similar to the Ban Phuc deposit.

Historical exploration work completed between 2005-2013 included 13 drill holes to test previous EM anomalies. The majority of these holes (8) intersected nickel sulphide mineralization. The remainder either missed due to the west plunge of the orebody or were drilled too steep to intersect a steeply dipping orebody.

To view Figure 1, please visit the following link: http://media3.marketwire.com/docs/1030348a.pdf

KINGSNAKE FLTEM

Field mapping and trenching undertaken during Q3 was followed up with two FLTEM surveys. The first FLTEM survey identified a number of strong conductors west of Kingsnake MSV. The second survey identified a larger moderate conductor coincident with, and directly west, of the known gossan.

The combination of structural mapping, trenching and the confirmation of the conductors at depth has provided specific drill targets and increased confidence in the conceptual targets generated in the structural review in Q2.

To view Figure 2, please visit the following link: http://media3.marketwire.com/docs/1030348b.pdf

FLTEM has increased the confidence in utilizing coincident nickel and copper soil anomalies to design future geophysical surveys. Such knowledge provides a significant exploration tool for future regional exploration targeting and continues to highlight the significant prospectivity of AMR's exploration package in North Vietnam.

The combination of mapping, trenching and FLTEM survey has identified an overall strike length for the Kingsnake structure of 1.2km from outcropping gossan to the last conductor. Kingsnake is located approximately 1km from the existing Ban Phuc mining and processing infrastructure allowing AMR to potentially leverage the significant historic investment in any potential development of the prospect.

To view Figure 3, please visit the following link: http://media3.marketwire.com/docs/1030348c.pdf

ABOUT AMR

AMR is one of the few new sources of nickel sulphide supply globally. AMR commenced commercial production from its Ban Phuc nickel mine in Vietnam in mid-2013. The Ban Phuc project currently produces over 6,900 tonnes of nickel and 3,500 tonnes of copper per annum contained in concentrate, plus a cobalt by-product.

In addition to in and near-mine expansion projects, Ban Phuc provides a cash-generative operating platform from which AMR can continue to focus on developing a new nickel camp within its 150km2 of concessions located throughout the highly-prolific Song Da rift zone, where AMR has a number of advanced-stage nickel exploration targets.

For further details on AMR, please refer to the technical report entitled "NI 43-101 Technical Report - Ban Phuc Nickel Project" dated February 15, 2013 available on SEDAR or the AMR website www.asianmineralres.com.

NZX Announcement: Aorere advises partial sale of Mosman holding and 78% increase in NTA

/16 September 2015

In recent weeks the value of our holding in Mosman Oil and Gas has increased significantly with a corresponding effect on the net asset backing of your shares. The net tangible asset backing (NTA) per Aorere share has increased 78% (from 0.18 cents per share to 0.32 cents per share) since 1 September.

In view of this substantial Mosman value increase we made the decision to rebalance the portfolio and have reduced our holding in Mosman to just over 5 million shares (3.46% of Mosman’s issued capital). This has released cash and created the ability for Aorere to invest in other projects.

Our Mosman shareholding remains our largest portfolio asset and we look forward with anticipation to participating in the ongoing growth of this dynamically managed company.

Regards,

Chris Castle, Managing Director

Aorere Resources Ltd

NZX Announcement: Mosman advises proposed strategic acquisition

/26 August 2015

NZX Announcement

Mosman advises proposed strategic acquisition

Mosman Oil and Gas made the following announcement in London last night. This appears to be a really significant acquisition and a game changer for Mosman. It’s also good news for AOR as

Mosman represents 38% of our portfolio.

Aorere Resources Limited holds approximately 5.3% of this AIM listed company, and our shareholding now has a present market value of NZD 578,000, based on the present market price of 3.12 pence.

Regards,

Chris Castle, Managing Director

Aorere Resources Ltd

London - 25 August 2015

Mosman Oil and Gas Limited

(“Mosman” or the “Company”)

Proposed acquisition of NZ producing oil and gas assets from Origin Energy Ltd

Further to recent announcements on a potential acquisition, Mosman Oil and Gas Limited (AIM: MSMN) the New Zealand (“NZ”) and Australia focussed oil exploration and development company, today provides further information on the proposed acquisition being the proposed acquisition of NZ producing oil and gas assets which include the Rimu, Kauri and Manutahi fields from Origin Energy Limited (“Origin”) (the “Project” or the STEP Project”).

It is proposed that the Project will be acquired for a total consideration of NZ$10 million (approximately £4.2 million). Subject to funding Mosman is currently expected to own a 40% interest in the Project. Mosman expects to partner with a privately owned independent oil company, which will acquire the balance of the project interest.

The proposed acquisition remains subject to the Company entering into acquisition documentation and Mosman will provide further updates in due course.

Proposed Acquisition Highlights

Proposed Acquisition of onshore NZ oil and gas assets.

The Project is expected to be operated under a joint operating agreement (“JOA”) and Mosman is expected to be the operator. The assets being acquired include the Rimu Production Station and two petroleum mining permits.

The Project is expected to be renamed the South Taranaki Energy Project (“STEP”).

Total expected consideration of NZ$10 million (approximately £4.2 million) to be paid in two tranches, the first tranche of NZ$7 million is expected to be payable upon completion of the acquisition and the second tranche of

NZ$3 million is expected to be due six months following completion. A 5% deposit will be paid by Mosman upon execution of the relevant SPA. Mosman’s total contribution towards the consideration for its currently expected 40% interest in the acquisition is expected to be NZ$4 million (approximately £1.68 million), the first tranche being NZ$2.8m (approximately £1.2m) and the second tranche being NZ$1.2m (approximately £0.5m). Mosman’s first tranche of consideration will be reduced by the deposit of NZ$0.5M (approximately £0.2m), which is expected to be paid by Mosman.

The Project assets include fully operational and established oil and gas processing facilities, equipment, permits, excellent infrastructure, assignment of key employee contracts and the assignment of relevant commercial contracts including oil and gas sales contracts. The facilities were the subject to a major refurbishment in 2014 and since restart in October 2014 have been producing an average 603 boepd. *

Origin is divesting the assets following a strategic review that the assets will be a better fit with a smaller Operator

STEP currently produces oil, condensate, gas, LPG and electricity, which deliver several revenue streams with payments being received in both US$ and NZ$. The Project also includes:

o 2P reserves of 1.9 Bcf gas and 1.4 MMbbl oil*

o 2C resources of 13.7 Bcf gas and 4.1 MMbbl oil*

o Prospective resources upwards of 179Bcf and 166MMbls*

Historically the Project has produced over 10 Bcf (10.9 PJ) gas and 1.58 MMbbl oil*

Current production of 603 boepd *(average production from October 2014 to July 2015) generates revenue of approximately NZ$8m per annum at current oil price and exchange rates.

Mosman has identified 12 low-cost projects that are expected to initially significantly increase production at an estimated cost of NZ$ 2.6 million.

Mosman intends to finance the proposed acquisition through a combination of existing cash, sale of royalty on future production, and debt. In addition, equity may be raised for the acquisition or for working capital and to accelerate development of the Project.

The proposed acquisition, when agreed is expected to be conditional upon a number of conditions precedent including; Mosman providing reasonable assurance of its financial capability to pay the total consideration due for the Project assets on or before completion and the granting of certain approvals from the NZ Government before settlement.

*Represents numbers supplied by the vendor that have been subject to due diligence by Mosman. Prepared to be consistent with the Society of Petroleum Engineers definitions as set out in Appendix 2

The Board of Mosman is well aware of the current oil price; volatility of oil price; and general equity market conditions. The STEP Project is being pursued for the following reasons.

The oil price has made quality assets available at a good price. This is possibly the best time to acquire reserves and production, both of which are attributes of the proposed acquisition

The proposed acquisition is in NZ$, which has seen an overall fall against the Pound and the US$ recently.

The oil sale price from production from the STEP is linked to Brent oil pricing, whilst the recent reduction in Brent oil prices is large in US$; it is moderated in NZ$ terms by the weaker NZ$.

This project currently produces more gas than oil; and gas is sold in the domestic market priced in NZ$, offsetting NZ$ operating costs.

The proposed acquisition, following execution of the relevant documentation, will not be completed for some months, and should the oil price experience further volatility then the following effects/conditions apply:

if the oil price increases, then revenues will be higher and focus will be on increasing oil production

if the oil price falls below, and remains below, US$40/bbl for a period of 15 consecutive business days at any time between the date of execution of the agreement and the settlement, there is expected to be a requirement for parties to meet and discuss such an event.

In any event, following the initial 12 low cost projects, there is further potential in the short to medium term for production to be increased at low cost from existing wells funded from operational cash flow.

Larger production growth projects in future can be considered and funded from cash flow as/when oil prices increase.

The Chairman of Mosman, John W Barr, said: “The proposed STEP Project is expected to be a transformational deal for Mosman as it is expected, upon agreement of the relevant documentation and completion, to deliver immediate production, reserves, facilities and cash flow. Numerous opportunities to increase production in the short term post completion have been identified and there is also significant upside production growth in the further development of the producing Manutahi oil field that has an identified oil originally in place figure of 30 million bbls.*

“We look forward to providing a further update in the near term when the documentation for the proposed acquisition has been agreed.”

Historical Financial Information

The STEP Project forms part of Origin’s NZ operations which in turn are part of Origin’s overall oil and gas operations. In addition, Origin applies a distribution of overheads to its various operations. Accordingly it has not been possible to isolate the STEP operations as a discrete financial reporting centre independent of the current corporate structure.

Mosman has prepared a ground up cash flow financial model taking into account current production; future production potential; oil and gas prices, exchange rates; fixed and variable costs; and operation development requirements such as the identified 12 low-cost projects that could potentially significantly increase production with an estimated cost of NZ$ 2.6 million following completion of the proposed acquisition.

The Mosman cash flow model is dependent on many variables including the matters referred to above. It will also be influenced by the final finance arrangements which include existing cash, sale of royalty on future production, and debt.

Given the planned reduction in current corporate overheads, and the anticipated operational success of the short term identified 12 low-cost upgrades referred to in this announcement, Mosman expects that the Project will be largely self-funding, apart from the NZ$2.6 million of investment referred to above.

Joint Operating Agreement

Mosman expects to enter into a joint operating agreement with its partner on the STEP Project.

The JOA is expected to provide for the establishment of a joint operating committee (“JOC”), to provide for the overall supervision and direction of joint operations on the Project. Mosman and its partner will each appoint a representative to the JOC. All decisions, approvals and other actions of the JOC will require the representatives of both Mosman and its partner to vote in favour.

Mosman is expected to act as operator of the Project and will do so in accordance with the directions of the JOC.

Management and Operational Continuity Plan in Place

Upon agreement of the proposed acquisition, Mosman is expected to be appointed the operator of the JOA and as part of that process it expects to retain key operational staff.

Mosman’s transition plans for the proposed acquisition provide it and stakeholders with the operational guidelines to manage the transition safely and efficiently and also addresses the following:

• Short term (three months) to full (six months) transition planning;

• Company resources and structure requirements;

• Scheduling and financial estimates;

• NZ regulatory health safety and environmental compliance;

• Plant integrity, PECPR requirements;

• Seamless production and revenue streams;

• Efficient transfer of all information.

Initial Production and Operational Upgrades

Having completed detailed due diligence, Mosman’s technical team has identified areas that would have the potential to significantly increase production levels within a reasonable time period.

As proposed operator, Mosman has prioritised and verified a list of opportunities that are expected to increase production, following completion of the acquisition, quickly and at modest cost, some of which are as simple as changing level sensors to avoid false alarms.

Initial potential production upside projects include:

· Restoring production to shut-in wells (workovers);

· Minor clean-up operations such as coiled tubing;

· Improving Manutahi D plant uptime by connecting additional (existing) tanks to increase retention time for solids settling, reducing the frequency of production shut down.

· In the medium term, Mosman, as operator, would Well projects targeting increased production at medium cost such as re-completions, water flood and facility de-bottlenecking.

· Larger investment projects, such as development drilling campaigns.

increase production via:

Subsequent Production Growth Opportunities

The oil in the Manutahi field is in a good quality reservoir at modest depth of 1,100m. The initial development wells were vertical wells. One of these has been a steady producer for more than ten years. Subsequent wells were completed with gravel packs, which was not successful as they became packed off with fine solids.

In a thermal water flood pilot containing one central oil producer and two water injector wells, Origin has also demonstrated that horizontal wells are effective producers flowing at several hundred of barrels of oil per day. This is a process known as Cold Heavy Oil Production with Sand (“CHOPS”) which allows for the both the viscosity of the 17 degree API oil and brings the fine solids to surface with the produced oil. Origin also demonstrated the benefits of re-injection of the hot produced water, which is expected to increase the recovery factor.

As proposed operator, Mosman’s current plans following agreement and completion of the proposed acquisition are to increase water injection (voidage replacement to maintain reservoir pressure) and to develop the Manutahi oil field with further horizontal wells. Whilst further work is required, initial studies confirm the Origin mapping and target recoverable oil of 4 million barrels (approximately a 10% recovery factor).

Facilities and Production Infrastructure*

The facilities and production infrastructure were the subject of a major health and safety and environmental review in 2014 when operations were closed for more than 6 months.

Agreement of Proposed Acquisition, Completion and Risk

Once the relevant acquisition documentation has been agreed, completion of the acquisition would be anticipated to occur within a few months but would remain conditional on a number of factors including financing, various NZ Government approvals (and other regulatory approvals that are normal for the transfer of petroleum permits of this kind including the change in operatorship). In addition to the purchase consideration, at completion the proposed acquisition will require initial working and development capital.

The proposed acquisition remains subject to the Company and its partner entering into formal acquisition documentation.

Existing Mosman Portfolio

The proposed acquisition does not alter the previously announced operational plans for Mosman’s extensive portfolio of existing exploration permits.

Details of STEP Project Mining Permits

The STEP Project include two petroleum mining permits, further details of which are as follows:

PMP 38151 (Rimu)

Granted: 30 January 2002

Term: 30 years

Expiry: 29 January 2032

Area: 18.42 sq. km

Permit: to explore for, develop and produce Petroleum, including gas, LPG, oil and condensate.

PMP 38155 (Kauri)

Granted: 14 April 2005

Term: 30 years

Expiry: 13 April 2035

Area: 35.24 sq. km

Permit: to explore for, develop and produce Petroleum, including gas, LPG, oil and condensate.

Competent Person's Statement

The information contained in this announcement has been reviewed and approved by Andy Carroll, Technical Director for Mosman, who has over 35 years of relevant experience in the oil industry. Mr Carroll is a member of the Society of Petroleum Engineers.

Enquiries Mosman Oil & Gas Limited

John W Barr, Executive Chairman

Andy Carroll, Technical Director

NOMAD and Broker

SP Angel Corporate Finance LLP

Stuart Gledhill / Richard Hail

Gable Communications Limited

John Bick / Justine James

NZX Announcement: Asian Mineral Resources Surpasses Production and Sales Targets

/21 July 2015

Dear Aorere Resources shareholder,

Our oldest investment, Asian Mineral Resources, made the encouraging announcement below in Canada last night.

Our shareholding in AMR is presently our second largest holding and represents approximately 27% of our assets.

Regards,

Chris Castle

Managing Director

ASIAN MINERAL RESOURCES SURPASSES PRODUCTION AND SALES TARGETS; BEGINS NEAR-MINE EXPLORATION DRILLING

Solid Production and Operational Outperformance, Significant Exploration Progress

Toronto, Ontario – July 20, 2015: Asian Mineral Resources Limited (“AMR” or the “Company”) (TSX-V:ASN) is pleased to provide an operational update for the second quarter of 2015 (“Q2”).

HIGHLIGHTS

· Above-guidance Q2 production[1] and sales :

- 2,342 tonnes of nickel milled production;

- 1,035 tonnes of copper milled production; and

- 21,489 tonnes dry concentrate sold.

· Mill recoveries continued to exceed targets at 86.8% nickel and 93.9% copper.

· Strong focus on cost continues with below-guidance C1 unit operating cash costs[2], including royalties and export taxes of US$ 4.55/lb Ni eq.

· Continued strong cash generation; debt reduced by a further US$2 million to US$12.0 million as at 30 June 2015.

· Commencement of an exploration drilling programme to test for deeper offset mineralization, below current workings.

· Completion of all mine capital development for current Life of Mine.

· Completion of tailings dam lift providing sufficient capacity for current Life of Mine.

Commenting on Asian Mineral Resources’ Q2 performance and exploration progress, CEO, Evan Spencer, said:

“AMR’s strong operational performance and cash flow generation have underpinned the business during this low nickel pricing environment. During the quarter, we repaid a further US$2 million in debt and completed all scheduled capital works, which will facilitate further cost reductions during H2 2016. With this low cost, high-grade production firmly established, we are now able to focus on our numerous near-mine, high-grade exploration targets. Drilling on one of the most prospective targets has now commenced and the team is excited to begin leveraging the geological potential of the region.

PRODUCTION

AMR produced 2,033 tonnes of nickel metal, 972 tonnes of copper metal and 66 tonnes of cobalt metal in concentrate in Q2 2015. Continued operational optimization has resulted in a further increase in process plant nickel recoveries to 86.8%, above the design target of 85%.

Four product shipments were completed in Q2 2015 in line with expectations, for a total of 21,489 tonnes dry concentrate. The average realized nickel price for the quarter was US$5.71/lb (US$12,593/tonne).

Key Operating Highlights

FINANCIAL

Continued focus on mine production, the completion of key capital expenditure and the planned ramp down in contractor equipment and manpower costs resulted in a further reduction in C1 operating cash costs, net of by-product credits and inclusive of all royalties and tariffs to US$ 4.55/lb (Q1 2015: US$4.63/lb).

The company maintains a strong cash and trade receivables position of US$ 9.8 million as at 30 June 2015.

During the quarter a further US$2 million of debt was repaid to LienViet Post Bank, bringing the total outstanding term loan balance to US$12 million as at 30 June 2015.

NEAR-MINE EXPLORATION

Underground diamond drilling has now commenced at Ban Phuc and is focused on a high-priority, high-grade target down dip of the existing MSV orebody. This follows work completed in the first quarter to identify the structural controls on mineralization within the mine corridor and wider region. The targeting of the off-set Ban Phuc Deeps target forms the first program of exploration work following Company’s decision to focus on near-mine exploration targets. Further analysis and drill targeting is underway with both Kingsnake and Ban Phuc East ranking as our next 2 high priority targets. Management is seeking board approval to commence drilling programs on these two prospects in Q3.

TAILINGS DAM

The final stage lift for the current Life of Mine (LOM) tailings dam was completed in Q2. Combined with the completion of all mine capital development, this marks the completion of all capital projects for 2015. The completion of key capital works at Ban Phuc allows for the significant demobilization of plant equipment and resources associated with the works, further reducing ongoing spend. This provides greater opportunity to reduce total spend and supports the Company’s focus on operational efficiencies and cost reduction in this low commodity price environment.

GOVERNMENT RELATIONS AND COMMUNITY

During the quarter, AMR was invited to participate in a Sustainable Mining Program in Hanoi supported by the Australian Government. This was hosted by leading international experts in sustainable mining and was attended by key Vietnamese government officials and departments including Ministry of Natural Resources and Energy (MONRE), Ministry of Industry and Technology (MOIT) and Ministry of Finance. The Sustainable Mining Program was opened by Vice Minister Ha. AMR’s invitation to participate highlights the Company’s ongoing leadership role in supporting the development of a long term, sustainable mining industry within Vietnam.

ABOUT AMR

AMR is one of the few new sources of nickel sulphide supply globally. AMR commenced commercial production from its Ban Phuc nickel project in Vietnam in mid-2013. The Ban Phuc project currently produces over 6,900 tonnes of nickel and 3,500 tonnes of copper per annum contained in concentrate, plus a cobalt by-product.

In addition to in and near-mine expansion projects, Ban Phuc provides a cash-generative operating platform from which AMR can continue to focus on developing a new nickel camp within its 150km2 of concessions located throughout the highly-prolific Song Da rift zone, where AMR has a number of advanced-stage nickel exploration targets.

For further details on AMR, please refer to the technical report entitled “NI 43-101 Technical Report – Ban Phuc Nickel Project” dated February 15, 2013 available on SEDAR or the AMR website

www.asianmineralres.com.

For further information

Paula Kember

Corporate Secretary

Telephone: +1 (416) 360-3412

Forward-Looking Statements

This press release includes certain “Forward-Looking Statements.” All statements, other than statements of historical fact, included herein, including without limitation, statements regarding completion of the project, the commencement of production and the achievement of expected benefits, potential mineralization and reserve and resource estimates, exploration results and future plans and objectives of AMR are forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of AMR to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Important factors that could cause actual results to differ materially from AMR’s expectations are disclosed under the heading “Risk Factors” in AMR’s Annual Information Form, and elsewhere in AMR’s documents filed from time-to-time with the TSX Venture Exchange and other regulatory authorities. Such forward-looking statements are based on a number of material factors and assumptions, including: that contracted parties provide goods and/or services on the agreed timeframes; that on-going contractual negotiations will be successful and progress and/or be completed in a timely manner; that application for permits and licences will be granted/obtained in a timely manner; that no unusual geological or technical problems occur; that plant and equipment work as anticipated and that there is no material adverse change in the price of nickel. Although AMR has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this press release. AMR disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements due to the inherent uncertainty therein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The scientific and technical information in this press release has been compiled and approved by Darryl Mapleson (BSc (Hons), FAusIMM) who is a Geologist retained by Asian Mineral Resources Limited and a Competent Person as defined by JORC guidelines and a Qualified Person for NI43-101. He has been working for Asian Mineral Resources Limited as an independent consultant.

[1] Refers to production of reconciled milled tonnes and grade with metal in ore (before mill recoveries).

[2] Defined as total operating cash costs including any royalties, export and environmental taxes per lb of payable nickel metal in concentrate produced, net of copper and cobalt by-product credits. In the period copper by products were US$3,005,726 for 972 tonnes of metal and cobalt by products were US$587,014 for 66 tonnes of metal.

3 Refers to Mine to Mill reconciled production.

[4] Refers to payable recovered metal in concentrate.

NZX Announcement: Antipodes Gold Transaction

/21 July 2015

NZX Market Announcement

Antipodes Gold Transaction

Aorere Resources (AOR) announced to the market on 2 April 2015 a conditional agreement (Agreement) to acquire certain gold joint venture interests from Antipodes Gold Limited (Antipodes).

Included in the Agreement conditions was Antipodes obtaining counterparty consents to the proposed transaction. Critically this included working through a pre-emptive rights process with the joint venture partner – Newmont Mining Corporation (Newmont). Newmont has now advised Antipodes that it intends to exercise its pre-emptive rights and acquire the Antipodes joint venture interests.

Accordingly it is likely this condition in the Agreement will not be satisfied and that the Agreement is now at an end.

A further condition of the Agreement was for Antipodes to make a full takeover offer for Chatham Rock Phosphate Limited (CRP). AOR holds a significant investment in CRP. The purpose of the takeover was for CRP to assume Antipodes’ listings on the Toronto Venture Exchange and the NZX Alternative Market to facilitate its phosphate investment diversification strategy.

Pleasingly the intention to undertake this takeover remains and the CRP and Antipodes Boards are now in discussions directly to progress this transaction further. The AOR board supports such a transaction in principal believing it will give CRP a stronger platform for re-building value.

Dene Biddlecombe

Chairman

Email: deneb@xtra.co.nz

NZX Announcement: Asian Mineral drills 1.79 m of 1.73% Ni at Ban Phuc

/Dear Aorere Resources shareholder,

This announcement has just been released by NZX.

Chris Castle

Managing Director

Aorere Resources Limited

Cell: +64 21 558 185

17 June 2015

Dear Aorere Resources shareholder,

Our oldest investment, Asian Mineral Resources, made the announcement below in Canada last night.

Our shareholding in AMR is presently our third largest holding and represents approximately 20% of our assets.

Regards,

Chris Castle

Managing Director

Email: chris@widespread.co.nz

Asian Minerals drills 1.79 m of 1.73% Ni at Ban Phuc

2015-06-16 11:34 ET - News Release

Mr. Evan Spencer reports

ASIAN MINERAL RESOURCES IDENTIFIES MULTIPLE NEW HIGH-GRADE NICKEL TARGETS

Asian Mineral Resources Ltd. and its subsidiary, Ban Phuc Nickel Mines LLC, have released the latest results of the exploration program at and around its high-grade nickel mine at Ban Phuc.

Exploration highlights:

- Confirmed continuation of massive sulphide mineralization downdip at Suoi Phang. Results include 1.79 metres at 1.73 per cent nickel (hole SP14-4);

- 14 new high-priority targets identified to date, taking the regional inventory for nickel and copper targets to 28;

- New, high-priority mine extension target at Ban Phuc Deep following detailed structural interpretation and geological history of Ban Phuc. Follow-up drilling at Ban Phuc Deep planned for late June, 2015;

- New brownfields targeting model developed;

- Greatly increased understanding of geology and the Ban Phuc feeder structure at depth.

Evan Spencer, president and chief executive officer for Asian Mineral Resources, commented:

"The discovery of new high-grade targets close to our mining and processing facility is extremely encouraging. We are particularly pleased with the confirmation of massive sulphide mineralization at Suoi Phang. As our recent operational announcements confirmed, the last 12 months of production have exceeded expectations, and we now have the cash-generating platform to aggressively pursue the growth potential of our 49.7-square-kilometre exploration area. Vietnam benefits from low exploration costs and very strong community support. With our increasingly detailed understanding of the geology, we are excited about the region's potential to host a world-class magmatic nickel sulphide camp."

Exploration program overview

In July, 2014, Ban Phuc Nickel Mines was awarded the exclusive mineral exploration rights for continuing exploration of nickel-copper mineralization over a 49.7-square-kilometre area surrounding its Ban Phuc nickel mine located in the Ta Khoa region in northern Vietnam. Ban Phuc is within the Song Da rift, a major crustal suture zone, which is part of a broader northwest-trending corridor of deep continental rifting known as the Red River fault zone, which extends from northern Vietnam into China, and hosts a number of nickel, copper, lead, and zinc deposits and occurrences. The area is an excellent geological address in a geo-tectonic and structural zone that has many favourable factors for development of different styles of nickel-copper deposits, including Norilsk, Jinchuan and Voisey Bay styles.

Ban Phuc's massive sulphide nickel-copper deposit (MSV) is hosted by metamorphosed sediments (the Ban Phuc beds) adjacent to an ultramafic intrusion, which also contains disseminated nickel sulphides. Ban Phuc occurs close to the core of the regional-scale Ta Khoa anti-cline, which also hosts a number of other surface nickel and copper, and ultramafic occurrences.

Drilling was undertaken at Ban Phuc and Suoi Phang in August and September, 2014. These results, along with low-cost underground follow-up work to expand structural and geological mapping, and geochemical sampling coverage, have been integrated into a 3-D geological study aimed at understanding ore distribution trends, ore genesis and to feed into the exploration targeting model.

Ban Phuc drilling and mapping

During August, 2014, six diamond drill holes totalling 2,506 metres were drilled below the base of previous drilling at Ban Phuc. Results are provided in the attached table. Holes were drilled as a platform for investigations into potential depth extensions to the Ban Phuc MSV. Interpretation of this drilling has led to a new, high-priority exploration target known as Ban Phuc Deep. Drilling aimed to test this target is scheduled to commence in late June, 2015.

Two holes on the eastern and western extremities intersected thin intervals of deformed MSV, interpreted to be boudin neck sections of MSV, which is a common form of structural segmentation that results from regional extension and is observed elsewhere within the Ban Phuc MSV in underground exposures. While there was a lack of contained nickel, features observed in logging of these holes indicate a geological structure that has offset, rather than terminated, the MSV. Four holes did not intersect MSV nickel mineralization.

Surface mapping and 3-D modelling of the proximal disseminated material that took place during the first half of 2015 have identified a previously unrecognized, late-stage fault network which is projected to intersect the MSV below 1,110 maximum rate limitation (mRL). Kinematic measurements taken at the surface indicate oblique north block down sense of movement. Previous interpretations concluded that Ban Phuc MSV terminated at around 1,110 mRL; however, this recent work suggests that MSV has been offset by a fault.

Ban Phuc geological model

Recent studies have also led to a changed interpretation of the genesis of the Ban Phuc nickel-copper deposit. Ban Phuc has previously been considered to have experienced amphibolite facies metamorphism, under which sulphides were thought to have been remobilized (under pressure) from the ultramafic intrusion and concentrated within the pressure shadow. Recent observations suggest the Ban Phuc strata is of greenshcist facies rather than amphibolite facies, with petrographic work currently being undertaken. If the Ban Phuc strata is in fact greenschist facies, this implies lower temperature and pressure were experienced during deformation. This is highly significant, as it invalidates the previous genetic model, and under the new interpretation, there are significant potential size and geometry implications for the MSV.

A new genetic model is proposed for Ban Phuc:

- MSV zone represents a conduit that ultramafic melts and fluids feed an intrusive, and may have seen more than one phase of fluid/melt intrusion;

- Sulphides accumulated in the feeder rather than in the intrusion. This emplacement model has analogies in other known deposits, most notable of which is Voisey Bay.

This genesis model explains the lack of massive sulphides within the Ban Phuc ultramafic, and also the proximal, but not basal, relationship between MSV and the ultramafic.

The key implication of this reinterpretation is that much larger dimensions of a massive sulphide deposit are now considered possible than what was previously assumed for the Ban Phuc MSV.

Having identified a structure that has caused displacement of the geological sequence, the company is focused on locating a potential offset continuation of the MSV. Underground mapping data collected since mining commenced in 2013 display evidence of local offsets and deformation consistent with the new genetic model.

Suoi Phang drilling

During September, 2014, four shallow diamond holes were drilled at the Suoi Phang prospect for a total of 253 metres. Results are provided in the attached table.

The Suoi Phang prospect, located 12 kilometres in a direct line from Ban Phuc, contains a significant outcropping nickel gossan with a mapped strike extent of over four kilometres. Historic trench samples returned encouraging nickel results with grades of over 5 per cent nickel, providing the prospect with the potential for discovery of a new MSV orebody. Drilling in 2014 proved successful in locating the downdip extension of the MSV that presents at surface as gossan, and results included a significant intercept in hole BP14-4 of 1.79 metres of 1.73 per cent nickel.

Additionally, drilling at Suoi Phang also identified a late-stage fault which is interpreted to structurally offset the MSV.

Regional fieldwork and structural review

Following drilling, AMR commissioned a detailed geological review to support its exploration program and continuing regional geological understanding. The geometry and position of the MSV at Ban Phuc within the regional strain field have been applied regionally, and used in conjunction with recent modelling of geophysics and geochemistry to detect and rank potential new exploration targets, and to augment ranking of existing targets.

The geological review was completed by an experienced, Vietnam-based resources manager (Michele Spencer), deputy director/exploration manager, Dinh Huu Minh, and renowned specialists Ben Grguric (nickel mineral systems), Brett Davis (structural geology) and Darryl Mapleson (BM Geological Services).

This work has been highly successful in identifying 14 new high-priority targets within three kilometres of the mine, and almost doubling regional target inventory for further investigation on the company's granted exploration concessions. Targets are currently ranked according to proximity to infrastructure, and favourable geophysical, structural and geochemical features.

Following the success of this work in the near mine area, plans to extend structural targeting regionally are scheduled for later in the year.

Planned future exploration work

AMR has commenced a staged exploration plan aimed to test high-priority targets, further refine near-mine and regional targets, and continue to search for new targets, as well as to continually build the geological understanding of the region.

Highest-priority targets are Ban Phuc Deep, described above, and prospects along the Ban Khoa trend.

The Ban Khoa trend is a grouping of targets which extend for over 2.8 kilometres of strike to the east of Ban Phuc. Occurrences along the Ban Khoa trend bear many similarities to Ban Phuc and are interpreted to be an easterly continuation of the same geology, disrupted by a northwest-trending regional-scale fault that has offset the package to the north. The key geological elements of 1) ultramafic intrusion into Ban Phuc horizon sediments; 2) mapped massive nickel sulphides and/or nickel plus or minus copper anomalism at surface; and 3) geophysical conductors that appear to wrap around intrusives, are all present along the trend.

Work plans have been devised to test and upgrade key targets, focusing on Ban Phuc Deep and regional targets. The exploration work plan has been divided into two stages.

Ban Phuc Deeps:

- Drilling to commence late June, 2015, initially with three holes including downhole electromagnetic;

- Subject to results of drilling and downhole geophysics, a further five holes for a total of 1,600 metres are planned.

Regional program -- stage 1:

- Fieldwork to be conducted by company geologists to expand structural mapping and geochemical soil coverage over regions of high prospectivity;

- FLTEM survey to test for potential conductive targets in proximity to near-mine intrusions.

Regional program -- stage 2 (subject to results of stage 1 and board approval):

- Further fieldwork to extend coverage, and scope of surface mapping and geochemistry;

- Extend coverage and scope of geophysics (may include other methods);

- Extend detailed geological understanding across broader groundholding in the Ta Khoa region;

- Drilling of priority 1 targets.

The scientific and technical information in this press release has been compiled and approved by Darryl Mapleson (BSc (honours), FAusIMM), who is a geologist retained by Asian Mineral Resources, and a competent person as defined by JORC (Australasian Joint Ore Reserves Committee) guidelines and a qualified person for National Instrument 43-101. He has been working for Asian Mineral Resources as an independent consultant.

Note: Intercepts are downhole widths; recovery of samples was 100 per cent;

samples were analyzed using a mixed-acid digest with an ICP finish at

Bureau Veritas Laboratory in Perth, Western Australia. The grid system used

is VN 2000 zone 104.5.

SIGNIFICANT ASSAY RESULTS OF MSV AT SUOI PHANG IN HOLE SP14-04

Hole ID From (m) To (m) Intercept (m) Ore type Ni (%) Cu (%) Co (%)

SP14 01 NSI NSI NSI NSI NSI NSI NSI

SP14 02 NSI NSI NSI NSI NSI NSI NSI

SP14 03 NSI NSI NSI NSI NSI NSI NSI

SP14 04 21.15 22.94 1.79 MSV 1.73 0.3 0.04

Note: Intercepts are downhole widths; recovery of samples was 100 per cent;

samples were analyzed using a mixed-acid digest with an ICP finish at

Bureau Veritas Laboratory in Perth, Western Australia. The grid system used

is VN 2000 zone 104.5.

Brief backgrounds of key people

Ben Grguric -- independent consultant

Mr. Grguric has worked in the mining and exploration industry since 1993 in both operational and exploration roles, and specializes in mineralogy, petrology and the detailed characterization of orebodies. He has also spent several years involved in commodity targeting, grassroots exploration, project evaluation and feasibility studies worldwide. Throughout his career, his role commonly involved boundary-spanning geology and mineral processing, as well as industry and academia liaison, including supervision of research projects and collaborative research programs. Specialty commodities include nickel, gold, platinum group elements, uranium and base metal deposits. Mr. Grguric is a graduate of the University of Adelaide (BSc honours) and the University of Cambridge (PhD). He has held senior technical and managerial roles in WMC Resources, BHP Billiton, Western Metals, Norilsk Nickel Australia and is currently a freelance consultant. He is an adjunct fellow at the UWA-Centre for Exploration Targeting and a research associate of the WA Museum.

Brett K. Davis -- principal structural geologist (Orefind)

Mr. Davis is widely regarded in the exploration and mining industry for his application of applied structural geology to numerous commodity types and mineral deposit styles. The approach Mr. Davis has brought to understanding mineralizing environments globally is a product of the integration of modern structural geology and techniques married with several decades of applied research. Mr. Davis received a BSc (honours Class I) from James Cook University (1986) and has completed a structural geology PhD (1992) at James Cook University, followed by six years of applied structural geological postgraduate research. Mr. Davis has over 20 years of experience in the mining industry, and currently holds an adjunct senior research fellow position at the University of Western Australia.

Darryl Mapleson -- principal geologist (BM Geological Services)

Mr. Mapleson, BSc (honours), has worked in the minerals industry since 1989. He has substantial operational and exploration experience in nickel; working in multiple Kambalda nickel mines and the Perseverance operation in Leinster, Western Australia. Significant achievements include the building of a mineral services group of interrelated companies, which includes a geosciences company, a downhole directional and geophysical surveying company, and a surface diamond drilling company. Mr. Mapleson has more than 25 years of industry experience, and is a fellow of the Australasian Institute of Mining and Metallurgy.

© 2015 Canjex Publishing Ltd. All rights reserved.

Final announcement for the year to 31 March 2015

/Financial Result

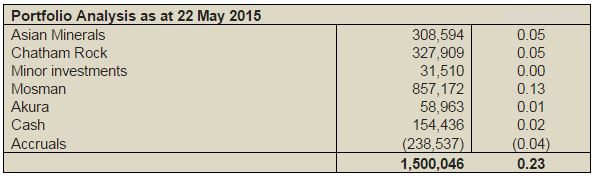

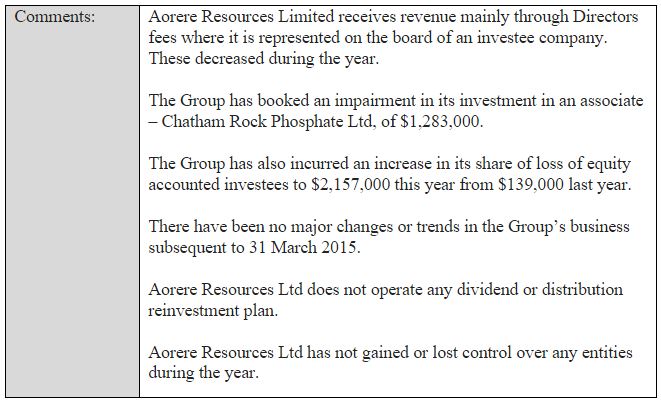

Your directors submit the audited financial statements of Aorere Resources Limited for the 12 months to 31 March 2015. The trading result for the period was a loss of $3.917 million. (2014 loss, $106,000).

Operations Report

As at 22 May 2015, our portfolio comprised the following investments

Mosman Oil and Gas

In late 2013 Aorere converted a 100% interest in onshore West Coast oil prospect (Petroleum Creek) into approximately 10% of AIM listed Mosman Oil and Gas Limited, which now holds the oil interest. We now hold an 8.7% shareholding in Mosman with a present market value of $857,000 at 4.6p.

Mosman holds the following broad portfolio of oil and gas interests and we look forward with confidence to seeing these projects progress.

New Zealand

Petroleum Creek - 100% of permit PEP 38526, a 143 sq. km low cost onshore exploration project located on the South Island.

Taramakau, Murchison and East Coast – awarded as part of the 2014 Block Offer, increased exploration area in NZ from 143 sq km to 2,317 sq km.

Australia

Officer Basin - 25% of permit, 22,527 sq. km with significant exploration potential.

Amadeus Basin - 100% two permits and one application in Central Australia, 5,458 sq. km one of the most prospective onshore areas in Northern Territory.

Otway Basin - 30% of VIC/P62 in the Otway Basin, relatively shallow water.

Chatham Rock Phosphate

Chatham Rock Phosphate (CRP) is the investment that we are most involved with operationally even though it presently represents only 22% of our assets. After taking up our full entitlement in the recent rights issue we are now the largest individual shareholder in CRP with 10.9%.

CRP holds a granted mining licence on the Chatham Rise and is pursuing five exploration licences offshore Namibia, first applied for in mid-2012.

Recently CRP’s marine (environmental) consent application was declined and CRP’s board has spent the past three months evaluating the decision to determine the most appropriate path forward. CRP has dramatically scaled down operations until such time as a resubmission of the marine consent application is deemed appropriate.

Regardless of the future of CRP’s Chatham Rise project, the CRP board has determined the company will evolve from its single project focus into a more diversified company, principally involving other phosphate projects, both on and offshore.

Accordingly, due diligence is being undertaken in respect of a number of phosphate assets based both on and offshore in Australasia, North Africa, Southern Africa, Canada, USA and South East Asia. They range from green-field exploration projects, to those in development and near-to-production. Other marine mining opportunities involving other commodities will also be evaluated by the CRP team.

The main drivers for this evolution in the CRP business strategy is not only the desire to reduce investor risk, but also to take advantage of (and therefore retain) the significant institutional knowledge and expertise within the Chatham management team and partner organisations. This knowledge spans marine and environmental science, the development of offshore mining projects, and extensive knowledge of the phosphate market, both locally and internationally.

Chatham directors consider (and we concur) that the company’s ability to finance the eventual resubmission of the marine consent application will be enhanced if both existing CRP shareholders and potential new investors don’t face the same binary EPA-decision risk as in the past.

The acquisition and development of these new projects within CRP would be significantly easier if CRP was listed on a more recognised and liquid overseas stock exchange. The Toronto stock exchange is the most logical one as it is a leading exchange for mining stocks and also has a major fertilizer component.

CRP directors considered various options for the most cost effective way of listing and identified a reverse takeover of an existing TSX.V listed stock as most effective. That process has started and CRP’s identified partner Antipodes Gold, is currently undertaking due diligence on CRP. Aorere is supportive of this reverse takeover as a means to list Chatham on the TSX.V

Asian Mineral Resources

Asian Mineral Resources’ nickel mine in northern Vietnam has now been operating for two years, after commissioning in May 2013. In April AMR announced that in the year to December 2014 it had beaten production and recovery targets and had achieved a strong cash flow and a maiden net profit. Significantly, AMR had also been awarded a mineral exploration licence in July, 2014, covering 49 square kilometres of highly prospective ground surrounding the existing Ban Phuc mine.

Commenting on the year-end performance, chief executive officer Evan Spencer said:

"We are extremely pleased with AMR's performance. The operations ramp-up is now complete and we have exceeded target production and sales. Also, despite a recent drop in nickel prices, our robust management of mining processes and cost reduction strategies will enable us to maintain solid cash flow going forward. At the same time, we are continuing to pursue multiple growth opportunities, with a particular focus on our advanced near-mine and regional exploration targets, including a study which is being conducted on the disseminated resource and the results are expected by June."

Akura

Aorere has 8% of Fiji oil explorer Akura, which is presently re-applying for oil exploration licences in Fiji

Earlier research and exploration by Akura has shown Fiji to have a high potential for the discovery of oil in onshore anticline traps associated with natural gas seepage, some dominated by butane. The main anticline target in the Nadi area has a projected length of 24 km, of which 12 km is coincident with natural gas seepage and such structures are capable of producing in excess of 100 million barrels of oil.

Outlook

To complement our Mosman and CRP investments, your directors recently made an offer to Antipodes Gold to acquire their interests in two Waihi located exploration joint ventures with Newmont Waihi. Newmont itself has pre-emptive rights in respect of both JVs but has yet to advise whether or not these rights will be exercised.

If they do not, and Aorere is able to proceed with the acquisitions we will hold interests in two very interesting, strategically located exploration tenements within shouting distance of the existing mining operation. While there will be associated work programme commitments we believe that these should be able to be financed by further equity raises. This confidence is based upon published exploration results achieved to date.

After a pretty tough year, we believe Aorere is now has regaining momentum and prospects are improving on a number of fronts.

Chris Castle

Managing Director

For the full statement - click here