Asian Mineral Resources provides Q1 2015 operational update

/ASIAN MINERAL RESOURCES PROVIDES Q1 2015 OPERATIONAL UPDATE

Solid Production and Operational Outperformance, Significant Exploration Progress

Toronto, Ontario – May 21, 2015: Asian Mineral Resources Limited (“AMR” or the “Company”) (TSX-V:ASN) is pleased to provide an operational update for the first quarter of 2015 (“Q1”).

HIGHLIGHTS

· Strong Q1 production[1] and sales:

- 2,427 tonnes of nickel milled production;

- 1,096 tonnes of copper milled production; and

- 20,874 tonnes dry concentrate sold.

· Above target mill recoveries of 87% nickel and 94% copper remained strong during the quarter.

· Continued strong cost performance:

- Unit C1 (all in) operating cash costs[2], including royalties and export taxes, were reduced to US$ 4.63/lb.

· Strong cash and trade receivables position of US$9 million and continued debt reduction to US$14.0 million as at 31st March 2015.

· Significant progress with exploration activities continued with detailed structural mapping and ongoing geophysical modelling and review both at Ban Phuc and across the regional tenement package. This work continues to add greater understanding to the structural controls on high-grade zones within the disseminated resource base.

Commenting on the Q1 performance, CEO Evan Spencer said:

“It is extremely encouraging for us that the Q1 2015 performance has demonstrated AMR’s resilient operation even under a tough nickel pricing environment. Robust plant performance and cost management, combined with a strong focus on delivering upon key business improvement initiatives, have continued to realize key cost savings. AMR has maintained its ongoing operational focus at Ban Phuc while at the same time being able to maintain momentum and progress with its near-mine exploration programme over the quarter.”

PRODUCTION

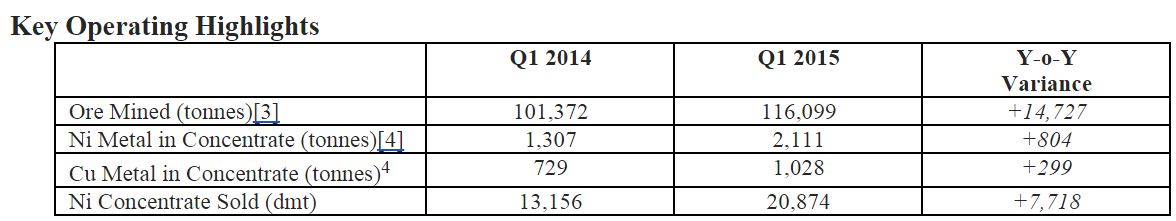

AMR produced 2,111 tonnes of nickel metal, 1,028 tonnes of copper metal and 69 tonnes of cobalt metal in concentrate in Q1 2015. Continue operational optimization has resulted in a further increase in process plant nickel recoveries to 87%.

Four product shipments were completed in Q1 2015 in line with expectations, for a total of 20,874 tonnes dry concentrate. The average realized nickel price for the quarter was US$6.18/lb (US$ 13,625/ tonne).

FINANCIAL

The solid performance in mine production resulted in reduced C1 operating cash costs, net of by-product credits of US$ 4.63/lb. The declining trend in cash costs is expected to continue into the following quarter, as work on mine development is progressing ahead of schedule and the initial ramp-down in contractor equipment and manpower costs is planned to commence during Q2.

The company maintains a strong cash and trade receivables position of US$9 million as at March 31, 2015.

During the quarter a further US$2.0 million of debt was re-paid to LienViet Post Bank, bringing the total outstanding debt balance to US$14.0 million.

GOVERNMENT RELATIONS

During the quarter, Decree 12 was issued by the Government of Vietnam, as an amendment to the Law on Royalty. The Decree lays out the methodology for calculation of the royalty, which includes an allowance for a deduction of certain production costs from the royalty calculation. This is expected to have a positive impact on AMR’s total cost basis.

COMMUNITY RELATIONS

Throughout Q1 AMR continued its community school program to provide safe and reticulated electricity to three local regional schools. This included lighting, kitchen and ablution facilities to promote AMR’s commitment to the community and local education. Additionally, AMR’s Ban Phuc community relations team continued to work closely with the “Buddy Back Pack” initiative, assisting in the sourcing and provision to schools of essential educational supplies for both children and teachers.

PROJECTS

Disseminated

AMR is currently in the process of updating the geological model for the disseminated resource and continuing with the associated metallurgical test work programme. The disseminated mineralization contains a number of localized high grade zones and is located immediately adjacent to the Ban Phuc underground mine infrastructure, providing a potential low-capex development opportunity. AMR will be publishing an update on the results of the disseminated resource during Q2.

The disseminated mineralization, should it be found to be economic, would represent a material opportunity for AMR to extend the mine life of Ban Phuc while continuing to investigate regional exploration options.

Near-Mine Exploration

Near-mine exploration continued steady progress with key structural mapping and ongoing soil sampling activities. The combination of EM work and structural mapping by OREFIND consultants has continued to develop our knowledge of the region and the structural controls on mineralization. This has enabled a revision to AMR’s strategic targeting and re-prioritization of exploration targets.